Subscriptions, search and shoppability: Social challengers go beyond the long tail

Analysis

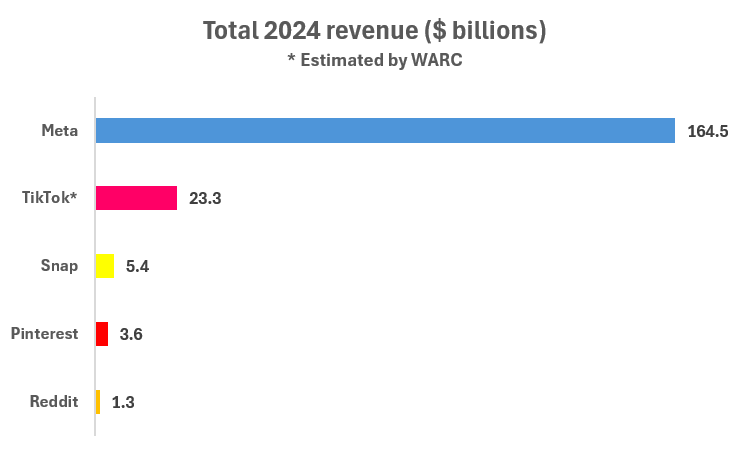

Meta has long remained dominant among social media companies in terms of total revenue.

Its Q4 revenue totalled $48.4bn, with full-year revenue of $164.5bn, driven almost entirely by advertising across Facebook, Instagram and WhatsApp.

Social media “challengers” with large consumer audiences like Pinterest, Snapchat and Reddit remain dwarfed by such figures despite strong annual growth in 2024.

Pinterest reported Q4 revenue of $1.2bn and full-year revenue of $3.6bn, while Snap reported Q4 revenue of $1.6bn and full-year revenue of $5.4bn. Reddit, the most recent social platform to go public, reported $427m in Q4 revenue and $1.3bn in full-year revenue.

Meanwhile, TikTok, which is privately owned by ByteDance, was forecast by Warc to generate $23.3bn in 2024.

For each of these social challengers, the outlined formula for driving growth looks broadly similar: develop tools to attract advertisers from small and medium-sized businesses (SMBs) and grow users to sell increasingly large audiences to these advertisers.

Such a tactic of chasing the long tail has become so familiar that even broadcasters are now getting in on it.

But given Meta’s massive audiences across Facebook, Instagram and now Threads, Eb Adeyeri, vice-president of paid social and strategic partnerships at Jellyfish, previously told The Media Leader that “What’s the overlap with Meta?” is the top point of consideration for marketers weighing whether and how much to spend on alternative platforms.

As such, for Snap, Pinterest and Reddit, growth momentum in the long tail — which occurred throughout 2024 (Snap more than doubled its number of active advertisers, for example) — is only part of the game.

Snap sees opportunity in creators and subscriptions

For Snapchat, attracting a larger market share of the creator economy is essential to growing its potentially lucrative TikTok-esque Spotlight feature.

In 2024, the total number of creators on Snapchat jumped 40% year on year, driven by a mix of new initiatives developed by the platform to lure them in as well as uncertainty about the future of TikTok in the US.

Addressing the latter, CEO Evan Spiegel acknowledged on the company’s latest earnings call that “the overall environment of uncertainty [around TikTok] is benefiting our business”.

“I mean, certainly advertisers are very focused on contingency planning and diversifying their spend,” Spiegel continued. “And I think the same goes for creators who are really thinking hard about how they can build the most diversified engagement with their fan base across various platforms, including Snapchat.

“So a big priority for us is really just helping make sure we support advertisers and creators during this period of uncertainty.”

Becky Owen, chief marketing officer at influencer marketing agency Billion Dollar Boy, told The Media Leader that there has been a definite “change in creator interest” in Snap following the announcement of its new creator revenue model in December.

“Rather than being over-dependent on brand deals — which can be unpredictable — the expanded monetisation opportunities and unified system offers creators more control over their earnings potential,” said Owen.

“As a result, we have seen creators experiment more with Snap as a way to unlock alternative revenue opportunities.”

TikTok ban uncertainty led US creators to focus on rival platforms

However, Owen noted that brand deals tend to be “less forthcoming” on Snap compared with competitors and that Snap’s adoption in creator marketing is “quite regional”, with higher popularity among creators in MENA rather than Western markets.

“While Snapchat is still not as dominant as other platforms for creators, we are certainly seeing creators recognise how important it is to diversify their platforms in order to grow their audience and revenue streams,” Owen concluded. “Snap can play an important role in making creators’ careers more resilient to platform disruption.”

Apart from developing its creator economy, Snapchat has also managed to diversify its revenue away from advertising. Snapchat+, the company’s subscription product, now counts 14m global subscribers as of Q4 2024, up 17% from the previous quarter.

Counted as part of Snap’s “other revenue” bucket, which more than doubled in 2024, Snap said Snapchat+ “exited the year with an annualised revenue run rate well over $500m”, suggesting confidence in the subscription model’s rate of growth.

Pinterest targets shoppability and ‘retreat from rage’

Like its peers, Pinterest has aggressively sought to increase its number of performance advertisers, developing swathes of tools to make spending easy and personalised targeting more appealing.

Last autumn, it launched Performance+, a new suite of AI tools aimed at boosting campaign performance while decreasing the amount of time required to create and activate a campaign.

“We’ve spent the last two-and-a-half years building a suite of lower-funnel tools that capture our users’ inherent commercial intent,” said CEO Bill Ready on Pinterest’s latest earnings call. “Our efforts are paying off.”

Ready suggested Pinterest is looking to invest in “curation experiences and the shoppability of our platform”, with the goal of helping brands target users as they “move more seamlessly from inspiration to action”.

However, Pinterest is not intent on becoming a retailer itself, but rather a “retailer’s best partner”, according to vice-president of performance Matt Crystal.

How useful are AI performance tools? With Pinterest’s Matt Crystal

The development is underpinned by a first-party data strategy that seeks to understand users’ consumer interests and tastes.

“We have very unique signals,” said Ready, referring to “hundreds of billions of first-party user actions” on what Pinterest refers to as its “taste graph”.

These give advertisers insights not just into individual users, but also to broader ideas and aesthetics associated with different brands. It also drives Pinterest’s algorithmic recommendations that aid in product discovery.

According to Ready, the size of the taste graph has grown by 75% in the past two years, helping to bridge “user activity, content and products across the platform”.

Apart from the increased focus on data and performance, Pinterest has also staked a claim in promoting a positive online experience perhaps more than any of its competitors.

Global chief marketing officer Andréa Mallard has previously called out advertisers for supporting rivals by pleading that “we do not need to trade our children’s emotional wellbeing for return on adspend”. Pinterest, she suggested, is an alternative that is “punching above our weight” after “years of playing catch-up” on performance-centred advertising.

In an op-ed for The Media Leader, vice-president and EMEA head of sales Milka Privodanova suggested that a more stable and brand-safe ad environment can be found on platforms that continue to emphasise inclusivity and tone down rage-bait engagement.

“Engagement through discomfort and rage doesn’t just exhaust us, it can drive us away,” she wrote. “Smart platforms will attract users seeking more positive and inclusive environments, thereby providing advertisers and retailers with greater returns on their investments.”

Reddit looks to search and subscriptions

Since going public in March 2024, Reddit has looked to establish a point of difference from competitors by focusing on the importance of communities, many of which are trusted to recommend products.

“If traditional social media is people you know really well talking about things that you may not care that much about, then community is people that maybe you don’t know talking about things you care deeply about,” according to Reddit senior managing director Paul Peterman.

Advertisers seem to find the argument that community-based targeting could be a more effective way of marketing at least somewhat convincing. On the latest episode of The Media Leader Podcast, MG OMD CEO Natalie Bell called Reddit “so interesting” in its ability to target niche and engaged communities.

But some communities (known as subreddits) may soon have the option to go behind a paywall as part of a broader revenue diversification strategy. In a video Ask Me (Almost) Anything session following Reddit’s latest earnings, CEO Steve Huffman said the platform is testing a “paid subreddit” feature that would allow users to create paywalled communities. The feature could be rolled out as soon as this year.

While details are scant at this stage, Redditors on the popular r/technology subreddit speculated the paywall strategy could be reminiscent of models such as Substack, Patreon or OnlyFans, giving creators the ability to directly monetise communities of supporters.

The latter comparison is perhaps apt. Reddit hosts a high amount of free-to-access adult content, with only a standard age-verification gate needed to access “NSFW” (not safe for work) subreddits. Huffman has previously said it is a “constant fight” to keep explicit content off the site; creating an option to institute paywalls to access such content could help contain a potential regulatory blindspot.

Huffman has also previously noted that improving its search experience for users and advertisers is a “focused area of investment“.

According to Reddit’s Q3 earnings, the term “Reddit” was itself the sixth-most-Googled word in the US over the previous 12 months, suggesting consumers have formed the habit of adding the keyword on to Google queries to receive answers from Reddit communities.

In Q4, Reddit missed its global daily active unique users target by 2m — a disappointment the company attributed to a change in Google’s search algorithm.

By developing an independent search product in the medium-to-long term, Reddit could wean off its reliance on Google for driving web traffic.

Calling search a “big opportunity”, Huffman has nevertheless hinted that it will take time to develop the product for advertisers.

“First we think about the consumer product,” he said last quarter. “When the product is in a more stable configuration, then we can start working on monetisation.”