The future of media agencies: Is long-overdue innovation on its way?

Opinion

Media agencies are under immense pressure. With new models emerging and more evidence of what advertisers want in the new world, change is afoot.

Most people in the know would agree that media agencies are capable of transformative work for their clients.

However, if they are being honest, they would also accept that it’s harder than ever to deliver great work due to the daily pressures they are under. The global networks are squeezed by their owners and their clients, who both want more with less.

Pay rises and bonuses are scarce. Hiring freezes are common, ramping up the workloads.

The old adage about having only two of “fast, cheap and good” has gone out of the window, to the detriment of the latter.

Beleaguered network agencies are forced to pursue the increasingly dubious extraction of client budgets through non-transparent practices in order to improve margins as their sibling creative agencies decline in status and revenue.

The need for additional revenue leads to an over-reliance on media vendor-derived income and trading mechanics that compromise the agencies’ role as strategic advisors to their clients.

Fee rates are often suicidally low after pitches and some media agency networks are offering clients “no fee” deals, with their revenue coming instead from their multiple media trading schemes — an inevitability given what has gone before.

The global networks offer “products” rather than services, making them a vendor, not a strategic partner.

Adtech dominance

Bob Hoffman is outspoken on this, as ever: “Adtech Int’l essentially owns the advertising industry. Agencies have become little more than the sales department for Facebook, TikTok, Google and the rest of the adtech rat pack.”

Except, of course, that a lot of principal/proprietary/inventory media isn’t online but has added whole new chunks of revenue from traditional media. But Bob’s not wrong.

Some of this is sort of understandable. After all, it’s easier to extract more from existing clients than go through the pain of having to pitch and win new accounts at often comically keen margins. But this used to be called “upselling” and was legitimate.

Independent media agencies are fortunate to avoid some of this pressure, but they have to compete for largely domestic business against the networks. Local accounts are usually higher-margin, so the networks need to win them to offset the losses on international business.

The independents have to fight the networks for the bigger local accounts with one hand tied behind their backs when they don’t have the additional media trading benefits to play with.

Fortunately, there are enough enlightened clients locally who value their agencies and pay them well.

All media agencies have the common challenge of doing more for less, as the permutations of content and channel grow and the need for more resources increases. Retail media networks and their equivalent have been added to the “must offer” list, with social commerce breathing down everyone’s necks.

The mountain keeps getting higher the more you climb and there’s less oxygen.

Squeezed dry

Meanwhile, clients are more skittish as ostensible metrics of success become both more immediate and less reliable. If performance lags, the temptation is to find a better or “cheaper” agency, rather than question the metrics or what drives them.

Pitch cycles get shorter as clients shop around, encouraged by the tendency towards a “product”-led approach by the networks and a corresponding loss of strategic status.

Client procurement teams advocate pitches if they’re under pressure to find savings, which substitute for revenue growth. “Value” is bandied around but is defined as whatever metric gets you through the night or not defined at all.

Contract compliance is a game of cat and mouse, and lacking the rigour of proper professions. Many of the media trading and auditing methodologies are 20th-century and under-automated.

Fees have been cut to the bone when they should increase to meet the demands for better thinking and an expanded range of data-led resources and services.

The old media agency model has been squeezed dry. With a dearth of new offerings, clients have extracted the juice, encouraged by the insane competition among the big groups and with a renewed emphasis on dressed-up media price in a market that calls for smart upstream business thinking first.

Interesting propositions

It’s quite a list, isn’t it? Maybe some people might see this as too negative a picture, but it is the reality that senior people confide to sympathetic commentators in private moments.

So where do we go from here? There are some interesting signs of movement in the market.

The independents are generally doing well, despite the pressures. As the client community starts to prioritise outputs rather than inputs, there is more emphasis on strategy and talent.

The7stars and Electric Glue continue to grow as a result.

There are some interesting new hybrids where creativity and media converge, such as T&Pm, although this is now fully owned by WPP and may change as a result.

Also interesting are VCCP Media and now Mother — both scions of great creative agencies exploring the re-convergence of content and channel.

Goodstuff Communications continues to fly the flag for media brilliance, even under new ownership. Craft Media has been very successful at demonstrating the value of media thinking isolated from trading influence.

The new agency brands, such as Jellyfish (now part of the interesting Brandtech Group), a newly funded Croud, Brainlabs and PMG (formerly RocketMill), are potentially very significant if they can use their new capital to move upstream from their more performance-led base (as Brainlabs has already done) while expanding into customer data media networks and connected TV.

And, perhaps most interestingly, a new model is emerging from Accenture Song, initially in Australia, where a consulting mindset is a leading part of the package. It has the scale and geographical reach to become significant. It aims to use technology to automate much of the downstream process, reducing cost and adding competitiveness of fees.

Also noteworthy is Know Company in Canada — a new model of holding company that is consulting and tech-led.

Looking for alternatives

Will the trickle of new offerings become a flood? The above examples are largely UK-localised and nascent, but there are signs that client demand is growing for alternatives. Some recent evidence is instructive.

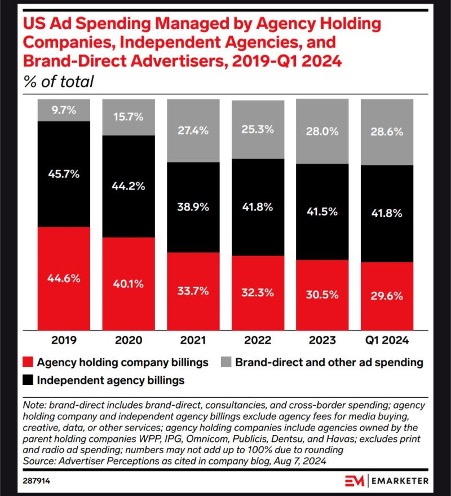

First up is data from eMarketer that tracks the US media market share of holding companies versus independent agencies and client in-housing.

First up is data from eMarketer that tracks the US media market share of holding companies versus independent agencies and client in-housing.

The decline in the big groups’ share is remarkable, largely at the expense of “brand direct”. The large digital platforms have made it easy to create and distribute ads on their platforms and attracted a huge number of online-only and omnichannel customers.

This matches the flow of money into online channels, where Warc estimates that 70% of all recent growth in adspend has gone to Meta, Amazon and Alphabet, with TikTok accounting for another big chunk and the new customer data media networks, social commerce and connected TV growing fast.

The stranglehold that big agency groups held in the days of mass media is coming to an end. The big budgets for TV in particular are on the wane and buying power matters less in the online age of biddable media.

Holding companies are fighting hard to attract clients that want integrated services, international coverage and data-led execution, but it is getting harder to compete in the newer channels versus specialist providers that are more flexible and affordable. The acquisitions by Omnicom of Flywheel and Publicis of Mars Digital and others aim to address this potential gap.

However, the move to non-transparent fees contradicts the demands from clients for more transparency into money and data for accurate measurement purposes. The holding companies are fighting back, but sacrificing their integrity along the way.

Substantial business model shift

More clues to the future come from the World Federation of Advertisers (WFA), which has been working with MediaSense on changing attitudes among advertisers. Their October 2023 report said that “the agency ecosystem is having to reinvent itself”.

It showed that only 11% of advertiser respondents thought their current agency set-up meets their future needs.

The finding that 74% of respondents agreed there will be a strong shift towards “output” or “outcome” metrics is encouraging, but calls for a substantial business model shift in an industry where salami-slicing media spend is the traditional model.

This year’s WFA/MediaSense report is equally insightful, saying that complexity calls for a new approach to agency remuneration.

Some 75% of respondents are looking to make changes to their payment model in the next three years. Some 61% say that they expect to pay their agencies more, assuming they can provide the strategic thinking, data and measurement and AI-led technology skills.

Talent costs, so will agencies be prepared to invest in people ahead of revenue during tough times?

In short, the advertisers surveyed want to align agency remuneration with business performance — an ambition that has existed for decades but which has never taken root. Now’s the time.

Trust also matters. To quote MediaSense: “The best advertiser-agency commercial relationships are built on a foundation of trust and transparency, acknowledging the need for both businesses to financially prosper by committing to a remuneration model that drives mutual success.” Should there be any doubt?

Any resemblance between this state of affairs and where we are today is probably coincidental. In the study, 75% of advertisers care how their agencies make money, but only 28% believe they have transparency of how the agencies earn from “pooled AVBs, opaque programmatic supply chains and inventory/principal/proprietary media”.

Flexible remuneration approach

Further evidence comes from an in-depth study among the marketing procurement community by Flock Associates, with additional commentary from the WFA.

The report predicts the rise of a “bionic agency ecosystem” where talent and technology converge, supported in the creator economy by virtual and in-house specialists.

All of this argues for a more flexible remuneration approach that is matched to business performance, mirroring the findings of the WFA/MediaSense report.

We have to hope that the marketing procurement respondents can execute on what they say they want. We live in an upside-down world where advertisers happily cut agency fees to the bone while overpaying massively for ineffective advertising. For example, ad fraud and poor viewability can consume a large chunk of the budget, but agencies get paid to handle the traffic anyway, often skimming revenues off the impression stream.

In a better world, agencies would be rewarded for eliminating ineffectiveness of all kinds; this would actually lead to far better outcomes on the budget or even, if savings really matter, to lower adspend and better-resourced agencies.

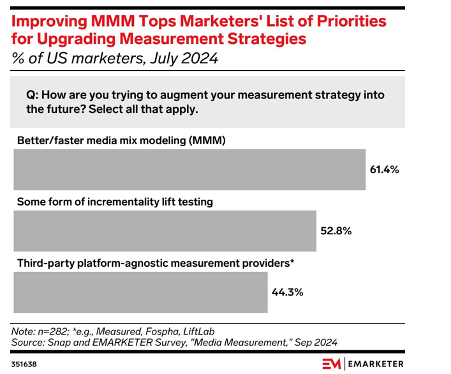

Incidentally, it is great to know that advertisers want to measure better; eMarketer data suggests they are especially interested in marketing/media mix modelling (MMM).

This is interesting for many reasons, not least that MMM tends to show mass-reach media producing better returns in both the long and the short term. Maybe time to buy ITV shares again.

Brilliant basics

Two final pieces of evidence show the way ahead. The first is from Relationship Audits. Based on a vast database of advertiser interviews, its work peels back the layers of what advertisers are looking for from their agency.

Advertisers are under huge pressure to grow while spending less (although cutting out the huge amount of wasted spend would be better than cutting agency fees).

They want agencies to be commercial partners and advisors, not vendors; providing business counsel, not just communications advice. This should be rooted in their in-depth understanding of the client’s business, but also what the client company wants to achieve and especially what the CEO would like to see. They, of course, want to talk the language of the boardroom, not media jargon.

They want the “brilliant basics”: on brief, on budget, on time. They don’t want their media agencies to be “platforms”, but they do want great data assets that produce real insights, not just more numbers. They want the experience and expertise of people who know how to turn insights into plans. Execution should be a function of objectives, not deals.

None of it surprises, but what is stark is how far we have moved from the kind of service we routinely delivered in former years.

Smart effectiveness measurement

The last piece of the jigsaw comes from The Aperto Partnership, which, like Flock, helps advertisers get the internal organisational and operational basics right first.

The Relationship Audits work shows that companies are forever in the middle of restructuring and have to change the proverbial tyres in the fast lane, so the ability to reorganise in-house resources is vital before choosing external partners and to do this regularly.

Canny agencies will obviously aid this process and fit their own resources around the client’s shape, not vice versa.

The advertisers that fail are the ones that try to hold on to 20th century processes while the world moves around them; marketing procurement can suffer from this syndrome without outside help and with the wrong metrics.

The Aperto work emphasises the need for smart effectiveness measurement as a linchpin of any operating system and this has to be designed around the geographic structures needed. It also needs to be much more than a hygiene factor.

End of an era

To sum up (finally), we are reaching the end of the era of the old media agency model. The future is here now and there is plenty of evidence of what advertisers want and need in the new world.

Different models are emerging and fresh thinking is starting to gain some traction, so we should see significant change over the next five years. It’s not optional.

Energised new players should grab the opportunity of change in the industry to open up new propositions, especially in the newer channels.

The holding companies should actively take advantage of their (potentially) integrated services and geographic reach to respond far better to changing client needs and wean themselves off a 20th-century business model.

Let’s hope we talk about this subject a lot more than we have hitherto. If innovation has been lacking, so too has an open discussion about the way ahead.

Nick Manning is the co-founder of Manning Gottlieb Media (now MG OMD) and was chief strategy officer at Ebiquity for over a decade. He now owns a mentoring business, Encyclomedia, offering strategic advice to companies in the media and advertising industry, and is non-executive chair of Media Marketing Compliance. He writes for The Media Leader each month.

Nick Manning is the co-founder of Manning Gottlieb Media (now MG OMD) and was chief strategy officer at Ebiquity for over a decade. He now owns a mentoring business, Encyclomedia, offering strategic advice to companies in the media and advertising industry, and is non-executive chair of Media Marketing Compliance. He writes for The Media Leader each month.