Three-quarters of advertisers want to change their agency compensation model

An overwhelming majority of advertisers (75%) are looking to make changes to their agency compensation model in the next three years.

That is according to the World Federation of Advertisers (WFA) and MediaSense’s latest report, which found that advertisers are increasingly putting a focus on more accountable agency performance.

Indeed, 74% of survey respondents indicated that they are seeking to better align agency compensation to business performance.

Ryan Kangisser, MediaSense’s chief strategy officer and co-author of the report, said the findings suggest “an overwhelming appetite to change”, adding that “it’s pretty unprecedented” to have so many brands looking to change their compensation models.

However, the Future of Media Agency Remuneration study found that logistical barriers are currently impacting the implementation of more accountable compensation models. Namely, 84% of respondents said they believe there is a lack of data and measurement between the advertiser and agency to facilitate a move to a performance-based model.

Mix of models, insufficient outcome

The report follows a WFA and MediaSense survey, released last year, that found just one in 10 multinational brands said they believe the current agency model fits their needs. Indeed, a quarter said the current agency model is “unfit for purpose”, with many citing a lack of alignment between remuneration models, agency incentivisation and desired behaviours.

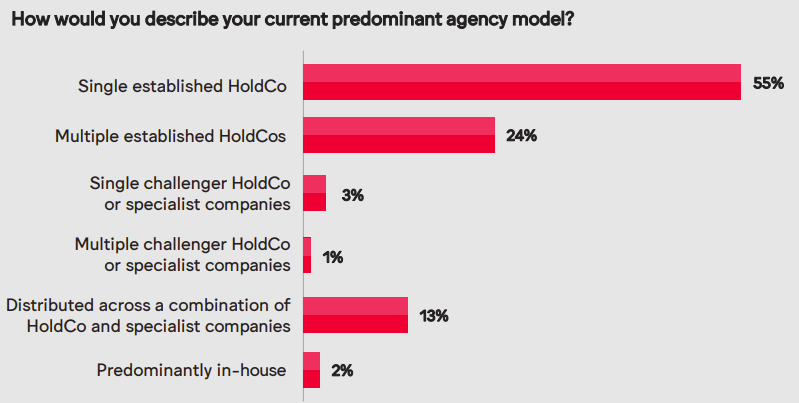

Currently, advertisers use a mix of remuneration models across their various agency relationships. More than half (55%) use a single established agency holding company, but 24% use multiple holding companies and 17% use a challenger holding group or specialist agency in some form.

Across those relationships, the study found a majority of current remuneration models are labour-based (63%) or commission-based (65%). In addition, 52% said they currently use an outcome-based model, generally in tandem with other models.

The study pointed out that such an approach is “symptomatic of the need for advertisers to maintain control and preserve flexibility in how they compensate their agencies”.

Despite this, advertisers still feel their remuneration model is not driving the right behaviours.

Move to performance-based fees desired

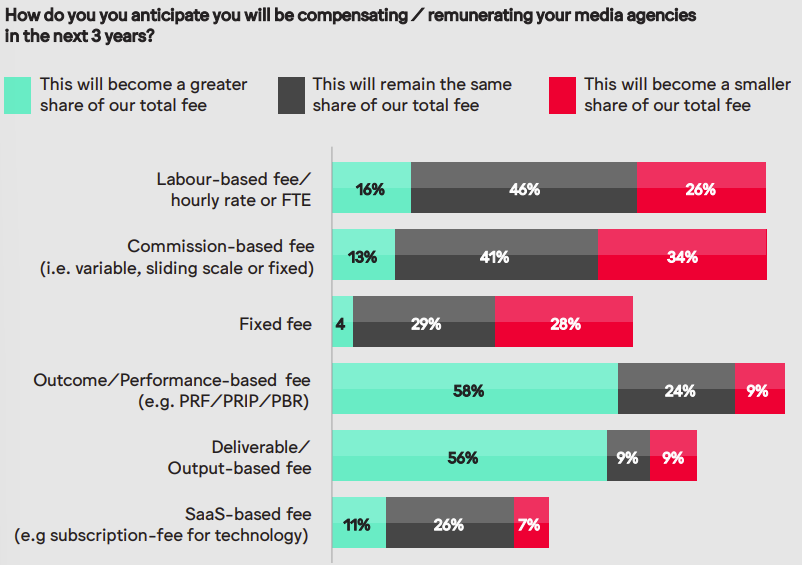

A majority of advertisers (58%) told the WFA and MediaSense that they expect outcome- or performance-based fees to increase as a share of their remuneration model.

Similarly, 56% said they anticipate deliverable- or output-based fees to increase over the next three years. Such a model is still in its relative infancy in media, with just 9% of advertisers currently using it.

Both are driven by the desire to align compensation with business performance, though other reasons for change cited by respondents include improving access to talent (42%), driving greater transparency (41%) and unlocking better client servicing and account management (40%).

One anonymous advertiser explained: “The big challenge, of course, is to prove the contribution of media campaigns to our business (rather than to just campaign, marketing or vanity KPIs).”

Another added: “There is an inherent misalignment of goals — we want outcomes such as sales and profit; agencies want to fill their capacity and bill hours without over-burn.”

An agency representative, on the other had, admitted: “We are keen to move to an output-based model, but it comes down to procurement teams and their comfort in buying services in this way. They are not there yet.”

Advertisers were found to be evenly split on whether there is transparency in how their media agencies make money on their business, with multiple advertisers expressing mistrust over the increase of principal-based media driving agency business models. Meanwhile, 87% said they believe agencies are resistant to adopt models that require greater transparency.

The report added, however, that as advertisers demand more outcome- or performance-based fees, agencies’ risk appetites will “inevitably decrease”.

“An agency is unlikely to relinquish a significant portion of their fee to this model considering all the factors affecting business outcomes that are outside of their control (and therefore which have a direct impact on the agency’s ability to make money),” it said.

Still, a majority of advertisers (61%) said they expect to pay their agencies more over the next three years.

What will AI do to remuneration?

According to the study, generative AI is poised to impact agency remuneration in the immediate future.

Advertisers view AI as a way to, in the long term, reduce fees. However, in the near term, they showed a willingness to pay more for generative-AI expertise to accelerate their marketing ambitions — a phenomenon that report co-author and MediaSense head of transformation Jack Shearring called “a paradox”.

Indeed, 54% of respondents said they will pay more for generative-AI talent. A majority also signalled a willingness to pay more for talent in strategy and planning (65%), data science and engineering (65%), and measurement and attribution (64%).

“In such a fast-moving and innovative field, advertisers will increasingly look to their agencies to plug knowledge and capability gaps in their own internal teams,” the report suggested.

However, lack of transparency on the value provided by technological developments remains a concern for some advertisers.

As one participant said: “As technology changes the way agencies work, there is little visibility to the positive impacts this has on the agency resources we require. We are not yet seeing the benefits of this improvement.”

Kangisser added that, more broadly, the “starting point” for creating change on remuneration “is really around transparency”.

Why agencies must move from a buffet model to à la carte service