TV companies could be world’s biggest creators if they fully embraced YouTube

“Big media” brands like Universal Studios, Disney and Warner Bros Discovery “could, and likely would be, the world’s biggest creators” if they used YouTube the way today’s creators and YouTube-native brands do.

This is according to media commentator and analyst Evan Shapiro, who reckoned “big media” needs to move beyond using YouTube as a place to host trailers and promotional videos and instead fully embrace the platform.

“YouTube is by far America’s biggest TV channel and it is nearly entirely controlled by social media natives and YouTube creators,” Shapiro commented, drawing on data from a report he has created in partnership with Tubefilter, a news outlet for the creator economy that provided him access to its YouTube analytics.

Shapiro noted that “big media” — a term he uses to describe long-established plus digital-native premium video providers spanning Nickelodeon to Paramount to Netflix — tend to be eclipsed in popularity on YouTube by creator-led natives like MrBeast, The Royalty Family, Laughability and Alan’s Universe, or by YouTube-centric corporate brands such as Vevo (a company he described as an organic YouTube master).

In a recent Substack post called “YouTube: A landscape”, he asked how much bigger the YouTube channels provided by “big media” would be if they were populated using a content-first mentality rather than treated as ads for content franchises.

“In a deeply fragmented media universe increasingly dominated by creators, big media’s content, characters, creatives and IP could allow them to traverse the gap between creator and mainstream platforms and grow a next-generation community of fans,” he said. “Yet traditional media continues to utilise YouTube primarily for promotion — ceding the platform to the natives.”

YouTube has become mainstream TV

He continued: “YouTube is now far more than social video. It has become mainstream TV for much of the world — especially for the youngest generation of viewers.

“The platform is so massive, and the data so daunting, it can appear simpler to leave it alone. But publishers, producers and artists who avoid the world’s biggest video channel will also leave the next generations of audience behind them.”

Shapiro worked with Tubefilter to better understand what is driving engagement on YouTube. Of the tens of millions of channels on the platform, Tubefilter defines at least 4.6 million as active, meaning they have at least 1,000 lifetime subscribers, one uploaded video in the last 90 days and 100 channel views within the last 90 days.

The joint study focused on the 4.6m active channels and came with an important caveat about how volatile YouTube data is on a per-channel basis over time. The viewing was monitored across a 30-day period to May 22, 2025.

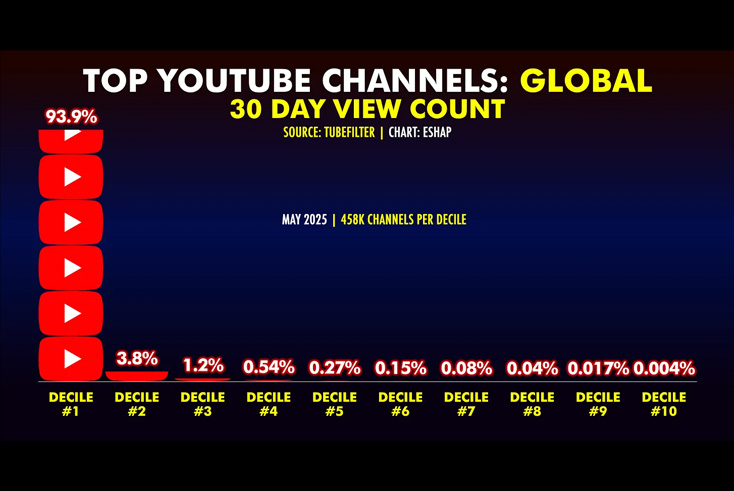

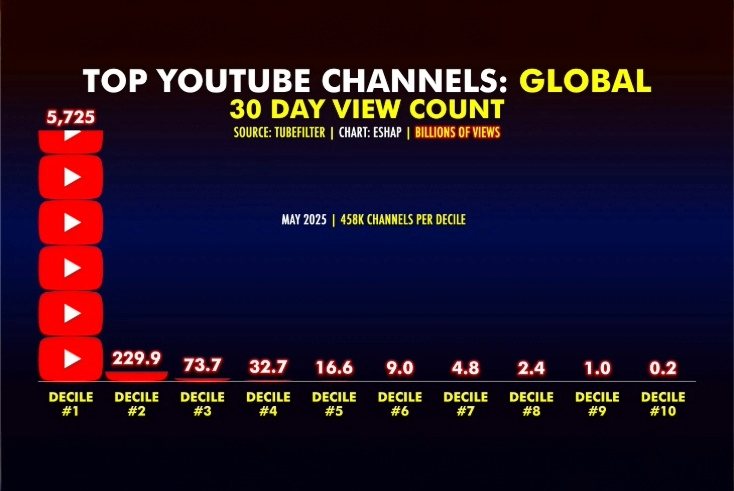

Together, the 4.6m active channels generated nearly 6.1tn views during the 30 days. Notably, the top 10% of channels generated approximately 94% of all views during this period, while the top 20% garnered 97.7% of all views.

“The most important words of the user-centric [content] era are ‘fragmentation, fragmentation, fragmentation’, Shapiro declared.

‘Personality reality’

The study found that YouTube remains creator-led, with 46 of the top 50 global channels described as creator-led or run by creator-led companies. The other four are described as corporate media-led and include Disney Kids (driven by trailers and teasers) and Cocomelon from the independent studio Moonbug Entertainment.

Moreover, the report explored the content and genres found in the top 50 global channels, spanning game play, dance, family vlogs, music videos, crazy challenges, news, sport and general entertainment.

“If there is a dominant trend or genre, it would have to be accessible characters doing weird stuff aimed at Gen A and Gen Z,” explained Shapiro, who dubbed this trend “personality reality”.

The report highlighted the importance of long-form content, covering 10-20 minutes or more, on the most popular channels. Shapiro cited long form as a trend that big media seems to have missed on the platform.

He argued that channels that focus on “personality reality” are hosting entertainment stars of the future, like the Kalogeras Sisters: “YouTube’s next Kardashians”. “This format has become the proving ground for a next generation of Jake Pauls and Charli D’Amelios — populated by stars that are eclipsing traditional TV,” Shapiro added.

Big media doing a good job

Shapiro cited some “big media” companies that considered to be doing a good job on YouTube. F1 (from Liberty Media) is described as a corporate brand that understands the assignment, with high-quality YouTube-centric content that is more than promos and which often runs to 10 minutes or longer.

BBC’s Bluey and Hasbro’s Peppa Pig are also commended for programming their channels as next-gen TV networks with YouTube-native content alongside long form that is clearly designed for TV.

Meanwhile, in a separate piece of commentary, Ampere Analysis has also been looking at the potential for professional long-form content producers to harness YouTube, observing that leading studios, producers and broadcasters are now uploading more full-length shows and films.

Ampere found that 38% of YouTube’s global monthly active users now enjoy watching traditional TV and film content on the platform. The figures come from its Q1 consumer data, which covers 29 markets.

The popularity of long-form content is being boosted by easy access to YouTube via the TV screen. Indeed, the Ampere data shows that 34% of those who watched both documentaries and TV shows/films on YouTube in the past month used a smart TV for at least some of their viewing.

Like Shapiro, Ampere believes TV companies cannot ignore the opportunity to extend their audiences using the platform, given its sheer scale and reach. The research group also pointed to the opportunity to generate new revenue streams via ad-share agreements with YouTube.