UK ’emblematic’ of Netflix’s approach to global programming

The UK has become “emblematic” of Netflix’s approach to content development, the streaming giant said in its latest earnings report.

While most of Netflix’s content spend remains in the US, the company noted that it is investing billions of dollars in commissioning programming produced outside the US that “keep our members happy”.

The streamer reported 12.5% year-on-year revenue growth in Q1 to $10.5bn — something it attributed to “membership growth and higher pricing”. It is the first quarter in which Netflix did not report subscriber figures, which have historically been used by analysts to gauge the health of the business.

Netflix first opened an office in the UK a decade ago, with the local team tasked with making and commissioning shows and films for UK audiences. But the quality of UK productions has also sparked popularity in other markets, providing an efficient net benefit.

Shows such as Adolescence, Toxic Town and Missing You were singled out by Netflix’s leadership as recent UK-produced hits that have found success with international audiences.

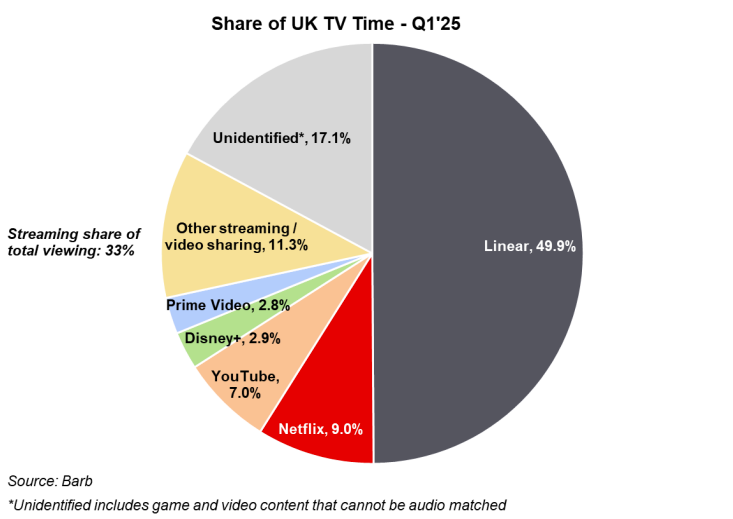

The streamer indicated that local slates are “improving each year” and the increased market fit is responsible for growing Netflix’s share of UK TV time from 8% in Q1 2024 to 9% in Q1 2025.

According to Barb data, Netflix currently trails only the BBC (20% share) and ITV (13% share) for viewing time, inclusive of both linear and streaming.

Analysis: British efficiency

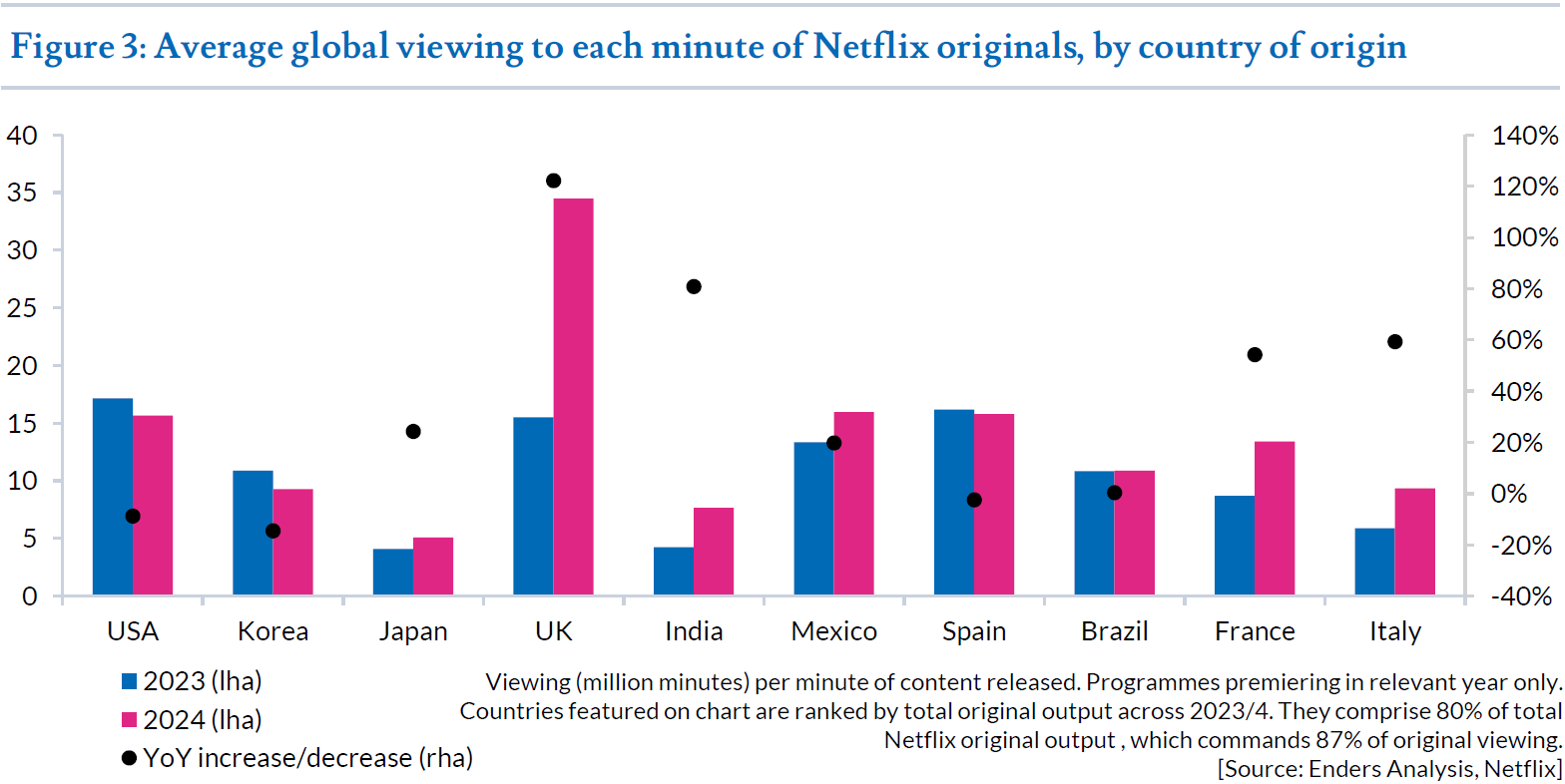

A report by media research group Enders Analysis released this week and viewed by The Media Leader found that British productions were by far Netflix’s most efficient source of programming by viewing time relative to volume of output.

Thanks to 2024 hits including Baby Reindeer, The Gentlemen, Fool Me Once and Black Doves, UK productions received the most viewing time per minute of content released, including more than double that of US productions.

“Much of this success can, of course, be attributed to the accessibility of the English language, which is a unifying force as a second language in much of the world and in most of the intense subscriber-growth areas,” wrote Enders Analysis head of television Tom Harrington.

However, he added that, given an estimated 40% of Netflix’s user base would likely view UK programming with local-language dubbing or subtitles, there is “something innate in the shows that makes them comparatively more attractive to the global Netflix view than content from other countries.

“Perhaps British exceptionalism in terms of the quality of its television product is not as over-egged as it has usually appeared.”

‘Positive indicators’ for upfronts

Netflix’s decision to exclude subscriber metrics going forward was made in part because the company felt it was no longer a reasonable metric to measure its business model, especially as the company grows advertising revenue.

That said, the streaming giant has also yet to report specific ad revenue figures.

Co-CEO Greg Peters previously stated that Netflix exceeded its ad revenue target in Q4 2024 and more than doubled its ad revenue year on year. On the company’s latest earnings call, he reiterated that the business expects to double ad revenue again in 2025, thanks to a combination of upfront sales and programmatic expansion.

“We’re seeing some positive indicators from clients as we approach our upfront event,” Peters said.

He added that Netflix is potentially insulated from anticipated macroeconomic headwinds given the business is “currently relatively small in ads” and this “probably provides us some insulation to market shifts right now”.

Meanwhile, the streamer is in the process of rolling out its own proprietary adtech in 10 more markets (including EMEA) after launching in Canada last year and the US this month.

“That offers a bunch of new capabilities that advertisers have told us they want,” said Peters. “We’re just starting to sell into those new capabilities. That opens up new opportunities for us, opens up new demand for us as well.”

Missing the full picture

Mike Proulx, vice-president, research director, at market research company Forrester, suggested that, by no longer reporting subscriber numbers, “it’s not possible to get a full picture of the health of Netflix’s business”.

He continued: “While revenue growth is what ultimately matters, it’s affected by several factors including price increase, which is partly why Netflix beat guidance expectations this quarter.”

The company has increased subscription prices in a number of key markets in recent months, including the UK, the US, Canada, Argentina and Portugal.

While Harrington believes subscriber numbers “have been a pretty useless data point for a long time” because comparing them between services is not especially useful (“A premium Netflix sub is hardly equal to a free Discovery+ sub bundled with a mobile contract”), not reporting subscribers “reduces a lot of the visibility about what is working at Netflix”.

“You would expect the company to formalise some new metrics over time that help to showcase the development of the business, including things like ad revenue,” he said. “That being said, even without subscriber numbers, Netflix still supplies more comprehensive data than anyone else, so you can hardly be too critical.”

For Proulx, Netflix’s overarching business strategy of using live programming — especially sports — to attract both new subscribers and advertisers is likely to pay off in the long term, regardless of the lack of metrics.

“The company’s careful selection of brand-appropriate properties and emphasis on tentpole events creates promotional buzz, drives tune-in and attracts advertisers,” he concluded. “Netflix’s superpower is down to its steady and compelling content slate. Now, with its determined foray into live programming, Netflix is able to […] bring appointment ‘television’ back into the cultural zeitgeist.

“All of this bodes well for acquiring subscribers and, subsequently, advertisers.”

‘Making us easy to buy’: Netflix expands programmatic offering in EMEA