Uncertainty and soft guidance as holding groups struggle for growth in Europe

Analysis

The major global holding groups highlighted macroeconomic uncertainty and generally presented soft guidance updates following a tumultuous Q1 in which the global economy began contracting in response to US president Donald Trump’s tariff policies.

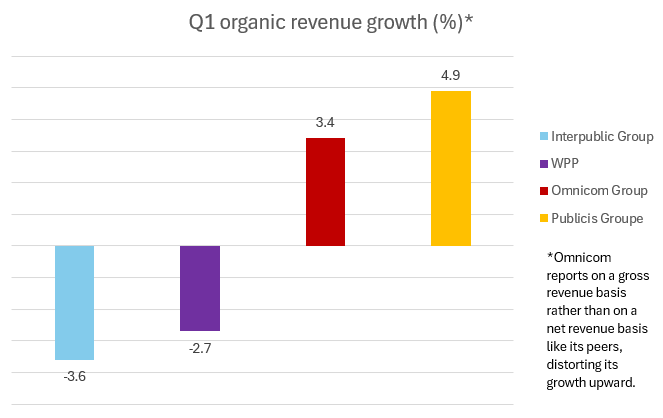

Publicis Groupe led the way with 4.9% organic growth in Q1. It was followed by 3.4% at Omnicom (although it reports organic revenue differently than its peers, making direct comparisons challenging).

On the other hand, both WPP (-2.7%) and Interpublic (-3.6%) reported declines. Interpublic predicted a 1-2% revenue decline for its full-year results and is taking steps to deliver $250m in cost savings this year ahead of its expected acquisition by Omnicom.

The lack of strong growth across the holding groups was particularly evident in Europe and the UK specifically.

For WPP, revenue growth declined 5.5% in the UK and 4.5% in Western Continental Europe. Omnicom grew revenue by 1.7% in European markets, despite a 0.7% fall in the UK. Interpublic’s UK revenue dipped most among the holdcos (at -6.1%) amid slight losses in Europe more generally (-0.4%).

According to industry analyst Brian Wieser, combined European revenues among the big four fell 1.3%, with the UK down 2.2%, although limited country data makes direct country-by-country comparisons challenging.

It’s Publicis’ world…

Publicis has remained the exception, with substantially stronger performance than its competitors in major regions.

The group reaffirmed full-year guidance of 4-5% growth. Business was exceptionally healthy in Latin America (+28.3%) and the Middle East and Africa (+11.5%).

Europe was again a laggard, with comparatively weak 2.7% organic growth. Both North America and Asia-Pacific grew 4.8% in comparison.

Publicis chairman and CEO Arthur Sadoun attributed the positive Q1 to a “record new-business run” that will “allow us to offset the potential effects of the deteriorating macroeconomic environment”, resulting in the optimistic guidance retention.

In contrast, WPP expects revenue this year to come in between 0% and -2%. Interpublic similarly is guiding between -1% and -2%.

While Omnicom is still anticipating growth (of 2.5-4.5%), unlike Publicis it downwardly revised its organic growth guidance due primarily to US tariff uncertainties.

…and we’re all living in it

WPP was the last of the four major global holding companies to report Q1 when it announced a 2.7% decline in like-for-like revenue less pass-through costs on 25 April.

CEO Mark Read warned that Trump’s tariff policy “will impact a number of our clients as well as the broader economy”.

“At this point, we have not seen any significant change in client spending and we reiterate our full-year guidance, which already reflected a challenging environment,” he noted. “As ever, we remain agile and vigilant, and will continue to be disciplined on how we are managing our cost base.”

Notably, GroupM, the company’s media investment arm and regular bright spot amid recent declines in other parts of the business, also saw a revenue decline of 0.9% in Q1 — a 3.3 percentage point decrease in growth from the year before.

GroupM’s acquisition of InfoSum during the quarter is aimed at helping WPP better compete on its data offering for clients amid a group-wide push to deliver efficiencies through AI-powered operating system WPP Open.

Whether it will be enough to compete with Publicis’ data-driven offering remains to be seen, although analysts have previously expressed scepticism of the holding groups more generally playing catch-up with Publicis rather than leapfrogging the top performer with a new model.

As senior Bloomberg Intelligence analyst Matthew Bloxham previously told The Media Leader, the “jury is still out” on WPP’s growth strategy.

“It hasn’t delivered market-leading top-line growth or margin expansion,” he said. “The cautious approach on M&A hasn’t delivered a step change in capabilities or taken them into new high-growth markets. The investments in AI are encouraging, but it’s hard to see how they are differentiated from what rivals are doing.”

For GroupM’s part, leadership is betting InfoSum will act as a “huge accelerator” for growth, according to Alex Steer, global chief data officer at WPP’s data and technology subsidiary Choreograph.

“It gives us a scaled technology that we can use to make that connectivity of data faster and more effective,” Steer told The Media Leader in a recent interview. “The pay-off to that is that the teams that work on our clients businesses have got more data, richer data, better-joined-up data available in their tools that they use to work.

“The other pay-off is that we are doing that in a way that is not putting that data at risk.”

Can consolidation compete?

Whereas WPP’s recent M&A has appeared targeted to better compete with Publicis’ data-first approach, the planned acquisition by Omnicom of Interpublic is all about scale.

Omnicom CEO John Wren said the “expected closing” of the deal “will give the combined company substantial opportunities for revenue growth and distinctive cost synergy potential to drive increased profitability, EPS growth and free cash flow”.

On the company’s earnings call, Wren explained Omnicom is actively developing plans for integrating its business with Interpublic.

“We have successfully organized our portfolio at Omnicom by aligning our agencies into marketing disciplines or practice areas to strengthen our depth of expertise and capabilities and to enhance collaboration across the group,” he said.

“This structure provides a seamless path for bringing together our operations with Interpublic, adding deeper expertise and capabilities to each practice area following the closing of the acquisition.”

The deal requires regulatory approval in 18 markets, including the US, the UK and the EU. As of Omnicom’s latest earnings, the group had secured approval in five (China, Colombia, Brazil, Saudi Arabia and Egypt), with Wren “100% confident” it will win approval from the rest in time to complete the acquisition during the second half of the year.

Uncertainty around the merger has been weighing on staff at Interpublic agencies, according to one source — particularly those who are not client-facing and thus more likely to have their roles cut or minimised amid a merger.

As Interpublic eyes cost cuts, Wren explained the combined entity is likely to have $750m in run rate cost synergies following the closing of the deal.

“We have clearly identified areas of synergy opportunity and our integration planning is well under way to ensure we achieve our targets,” he said. “We believe our multi-year plan and the successful acquisition of Interpublic will create significant shareholder value.”