“This is the most unhelpful bit of language the industry has come up with.”

At an event hosted by Thinkbox at Bafta in London last week, leaders in marketing science at GroupM agencies Wavemaker and EssenceMediacom implored a packed crowd to eschew the terms “performance” and “brand” when considering channels to include in media plans.

Dominic Charles, managing director, audience intelligence and marketing science at Wavemaker, admitted that while there is “some truth” to considering channels differently due to the types of creative and messaging opportunities they offer, “to arbitrarily break the media channels into ones that do performance and ones that do brand, and then put them into some sort of adversarial relationship with one another, is arguably ill-advised”.

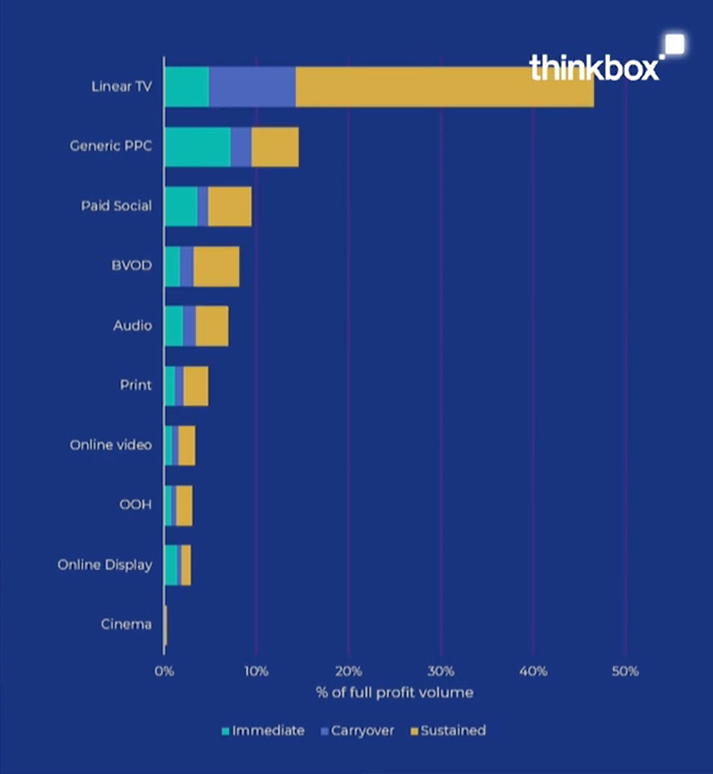

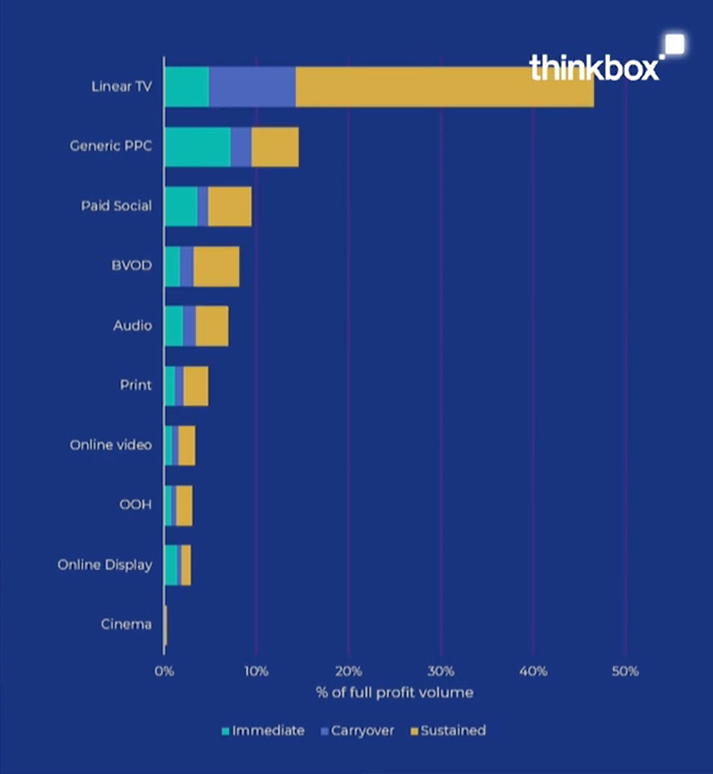

Charles said doing so was “fundamentally untrue as to how media payback works”, given that, according to the latest Profit Ability 2 study, many channels that would classify as “brand channels” deliver on outcomes more closely associated with “performance channels”.

He added that such language also “undermines” the case for advertising. Performance advertising naturally has more positive connotations given it delivers immediate, measurable return on investment.

“If you come to me talking about brand media, it starts to feel quite theoretical, like I have to read a textbook to understand how this helps my business,” Charles said. “It starts to feel a bit distant and fuzzy.”

Advertising generates profit, but not all media channels are equal

A better model

Charles recommended that, rather than looking at media buys through the lens of performance versus brand, marketers should consider three dimensions of effectiveness: scale, efficiency and time.

Scale is defined as the size of the advertising’s impact on the business. Efficiency is the ratio between cost and payback. Time is the period over which one wants to maximise payback.

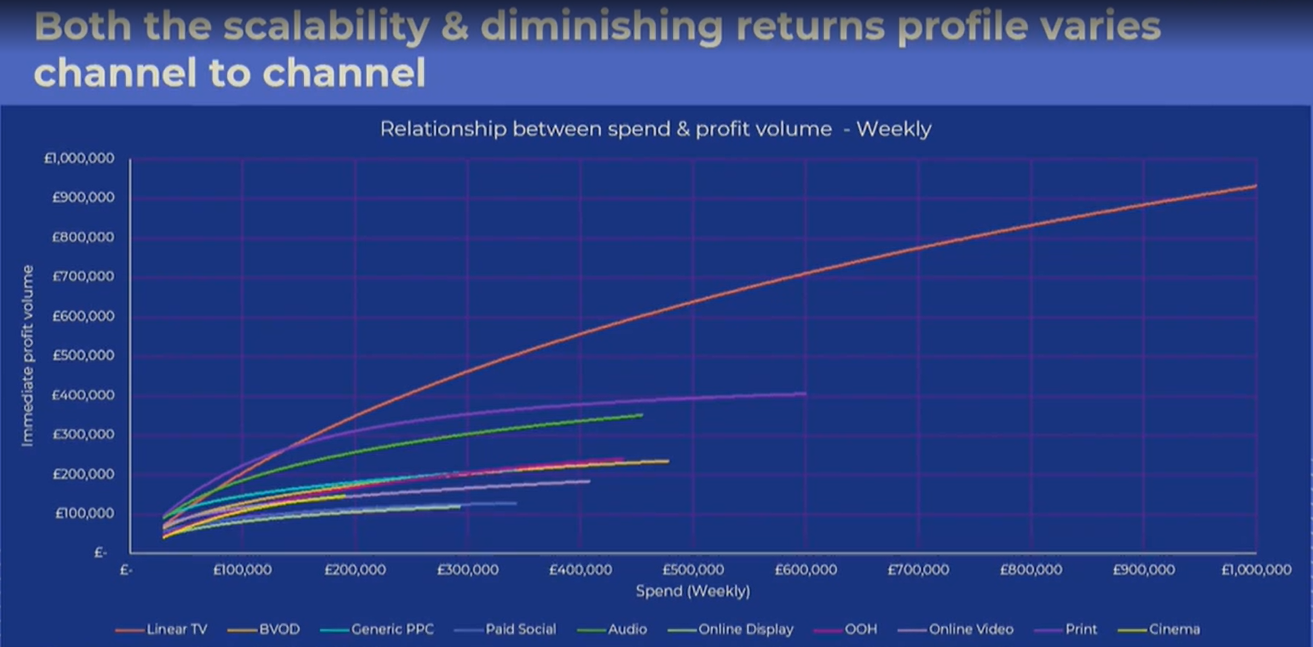

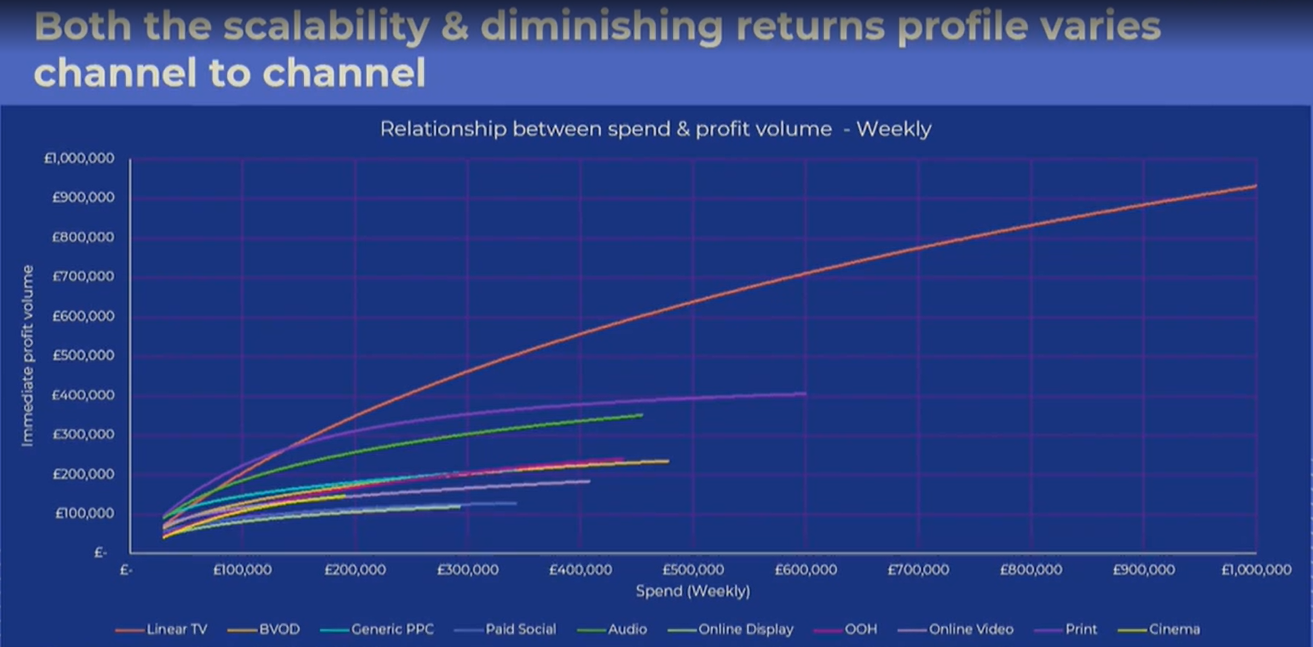

Charles noted that “fundamentally, you can increase scale in all channels if you increase your spend in them”. However, different channels experience diminishing returns at providing scale at different levels, with linear TV providing the least diminishing returns for every additional dollar spent compared with other channels.

“TV’s advantage is its scale,” he explained. “The other channels tend to hit diminishing returns and plateau off and get less effective at relatively modest spends.”

He added: “Just because something has a high ROI doesn’t mean that ROI sustains when you put more spend through it.”

Efficiency thus has a “symbiotic relationship” with scale. As a channel hits diminishing returns, ROI gradually reduces. Charles recommended considering different channels’ “saturation points” — that is, the point at which spending an additional dollar on a channel no longer gives a full dollar in return.

“What’s quite interesting from an efficient scale point of view is that some of the channels around TV are not the really targeted digital ones that we all get excited about and read a lot about,” he continued. “It’s things like print, audio, even cinema and outdoor, which have reasonably modest ROIs in general — [they] actually handle scale much better than some of the other channels.”

On the other hand, channels that saturate quickly and fail to drive efficiency at scale include display and social. This makes sense, according to Charles, because their strengths are personalisation and hyper-targeting, which inherently do not scale as well.

Timing is key

Jane Christian, managing director of analytics and insight at EssenceMediacom, explained the importance of the third consideration, time, which relates to when the business needs to see positive impacts from advertising. Shorter time horizons will tend to lend themselves to certain channels compared with others.

For brands seeking immediate payback, “performance media” such as generic pay-per-click (PPC) and paid social tend to perform best in the initial week or two.

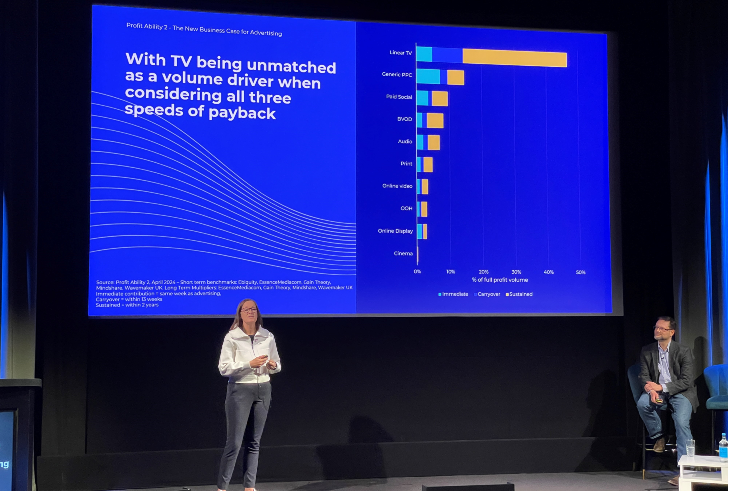

However, as the Profit Ability 2 study found, channels considered “brand media”, such as linear TV, audio and broadcaster video on demand (BVOD), also drive significant uplifts in the short term. Even print outperforms online video in terms of immediate payback, according to the study.

“Going back to ‘performance’ and ‘brand’,” said Christian, “it’s a real arbitrary term, because if you’ve got something like linear TV that can deliver this much volume in a week, then it can work in a ‘performance’ way.”

Don’t forget multiplier effect

In the longer term, different channels rise to the fore in terms of providing a “multiplier effect” on payback. Linear TV, BVOD, OOH and print all provide above-average multiplier effects.

“That makes sense, especially for the video channels here,” explained Christian. “Video has an unrivalled ability to build memorability, which translates into a bigger long-term effect and ability to change perceptions.”

She noted that even channels on “the lower end of the scale” — such as generic PPC, online display, paid social and audio — still have long-term effects, albeit comparatively smaller.

Furthermore, long-term effects vary significantly by brand; automotive and FMCG brands receive above-average long-term effects, for example, compared with other categories.

“In our opinion, ‘brand’ and ‘performance’ as a terminology doesn’t really effect how advertising is actually paying back,” concluded Christian. “We think it’s better to think about scale, efficiency and time as the dimensions that should direct what your optimal media mix is.”

She added: “Don’t just think that digital channels drive business immediately. All channels do. And the sooner we move away from that brand/performance definition, the better.”