‘Worrying’ spike in sales promotion: Bellwether exposes ongoing economic anxieties

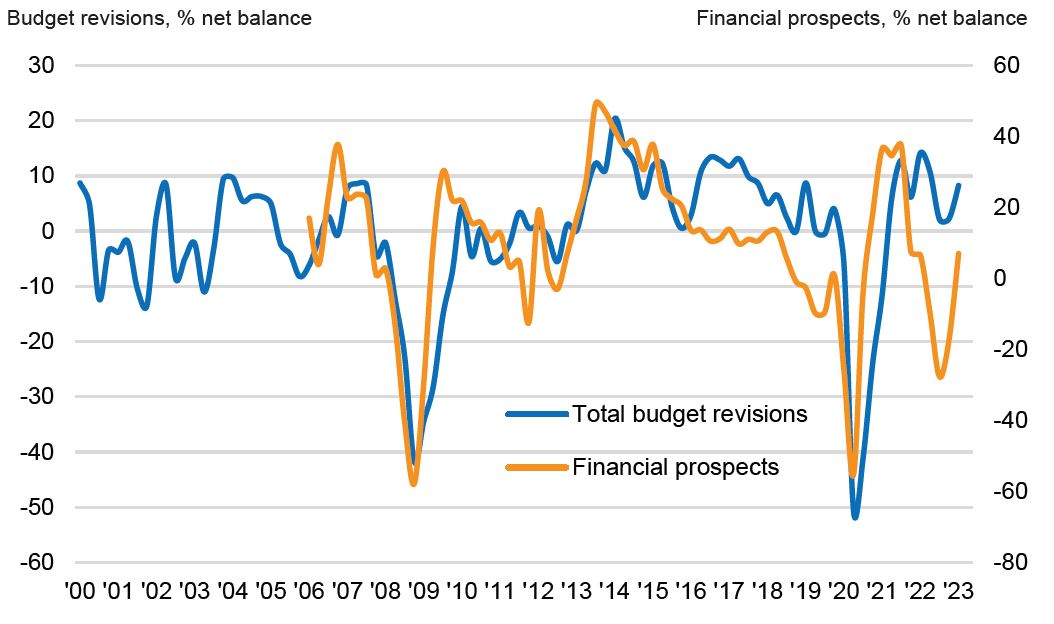

Against a challenging macroeconomic environment, total marketing budgets in the UK continued to rise in the first quarter of 2023, according to the IPA’s latest Bellwether report.

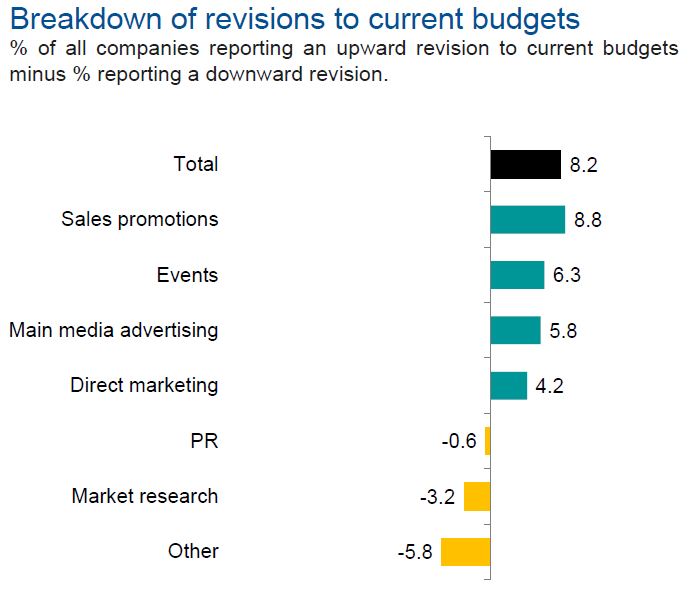

Growth in spending was its strongest since Q2 2022 with the net balance of firms registering upward budget revisions rising from +2.2% in Q4 2022 to +8.2% in Q1 2023.

Joe Hayes, senior economist at S&P Global Market Intelligence, reflected on the latest report as further evidence of the strength of the UK’s marketing industry. “The latest Bellwether survey once again highlights the resilience of UK businesses who have endured both a pandemic and a period of plunging consumer confidence and multi-decade high inflation,” he said. “Total marketing budget growth broadened out during the opening quarter, showing that more companies are tapping into their marketing resources to help them successfully navigate through economic turbulence.”

Main media marketing, which includes online advertising activity and budgets for big-ticket campaigns on TV, meanwhile recorded its strongest expansion in spending since Q1 2022 (net balance of +5.8%, from +4.4% in the prior quarter).

The breakdown of this category showed continued marked expansions in other online (+10.5%, from +6.3%) and video (+7.9%, down from +13.7%), and a renewed upturn in audio (+1.7%, from 0.0%). Published brands (-1.9%, from -3.9%) and out-of-home (-12.4%, from -8.8%) were drags on main media in Q1, however.

Spike in sales promotions ‘worrying’?

Notably, sales promotions rose at the strongest pace in nearly two decades (+8.8%, compared to -4.0% in Q4 2022) as companies dedicated more resources to supporting their customers through the cost-of-living crisis. Another round of budget growth was also seen for events (net balance of +6.3%, from +5.7%) as marketing executives continue to look for ways to engage with consumers face-to-face. Direct marketing spending also rose at the start of the year (net balance of +4.2%, from -0.6%).

IPA director general Paul Bainsfair reflected that it is understandable for companies to offer sales promotions to help ease their customers’ tightened purse strings as the cost-of-living crisis continues. The latest inflation figures, released Wednesday, found that the UK still suffered from double-digit (10.1%) inflation in March, with food prices rising at the highest rate since 1978.

But Elliott Millard, chief strategy and planning officer at WPP media agency Wavemaker, described the spike in sales promotions as potentially worrying, telling The Media Leader that brands and marketing are ultimately about defending against price sensitivity.

“In the current climate, a brand that invests in its own proposition and can avoid discounting is likely to be more successful than a brand that chases volume over value,” Millard said. “Obviously, there is nuance here — brands need to think about their own cost base, their demand pool and their supply chain. However, we need to remember the power of marketing not only to shift bottom line numbers but also to defend price increases.”

At least in the first quarter, companies were able to balance the spike in sales promotions with continued growth direct marketing. David Mulrenan, chief investment officer at Publicis Groupe media agency Zenith, noted that “rather than it being a choice of long-term vs short term, [companies] are managing to keep both avenues on the go.”

“There is no doubt that this year will continue to be challenging with the cost of living and potential summer strikes, however for the brave marketers there are plenty of signs that consumers are re-evaluating their brand choices during this period, and this presents a great opportunity,” he added.

‘Potential opportunity to exploit’

Looking ahead, the latest Bellwether report upgraded its forecast for the UK economy, now expecting GDP in 2023 to decline by -0.2% instead of the -0.8% anticipated in Q4 2022. However, the report attempted to temper optimism, noting that households’ continuing decline in purchasing power due to high inflation and borrowing costs will “weigh on the economy immensely”.

The report also downgraded its 2023 adspend forecast (-0.9% vs. -0.3% previously), though it couched the decline as “normalisation” after 2022’s strong growth. More than a third (36.6%) of Bellwether respondents still said they foresee greater total marketing spend in real terms in the year ahead, compared with 16.9% anticipating cuts (net balance of +19.8%), reflecting optimism particularly for events (+14.5%) and main media advertising (+13.5%).

But Ian Daly, head of activation at independent media agency Bountiful Cow, told The Media Leader it would be foolish to pay too much attention to year-over-year spend figures or project ahead with high confidence given the tumult of the past 12 months in the UK economy.

“What we’re seeing – both from consumers as well as clients – is a growing sense of familiarity (or dare I say, comfortability) in the face of evolving externalities,” he said. “Many have already made the difficult sacrifices necessary over the last six months, and so now the focus is on using the tools available to them to make the most of 2023.

“For some, that means leveraging existing brand assets across proven channels; for others, that means experimenting with new strategies and tactics in unproven environments. The key is relativity; brands that are able to exploit audiences or channels that are underserved by their category have a chance at making their marketing pounds go further.”

Daly recommends that channels that may “come across as unloved” in the latest Bellwether report, such as publishing and OOH, should be seen as a “potential opportunity to exploit, rather than a fading area to avoid.”