In the opening session of the Future of TV Advertising Global 2025, Richard Broughton delivers a whistle-stop-tour of who the winners and losers are in an increasingly consolidated market.

Netflix, Disney+ and Prime Video will be subject to the same Ofcom scrutiny as traditional broadcasters such as the BBC and ITV.

Welcome to the Brief for Monday 8th December, The Media Leader’s round-up of media news.

The transaction, valued at $82.7bn (including debt) is expected to close by Q3 2026, after Warner Bros Discovery carves out its linear TV businesses into a new company, Discovery Global.

The brief – The Media Leader’s daily round-up of media news.

The brief – The Media Leader’s daily round-up of media news.

The Media Leader’s daily round-up of news for Thursday 27 November 2025.

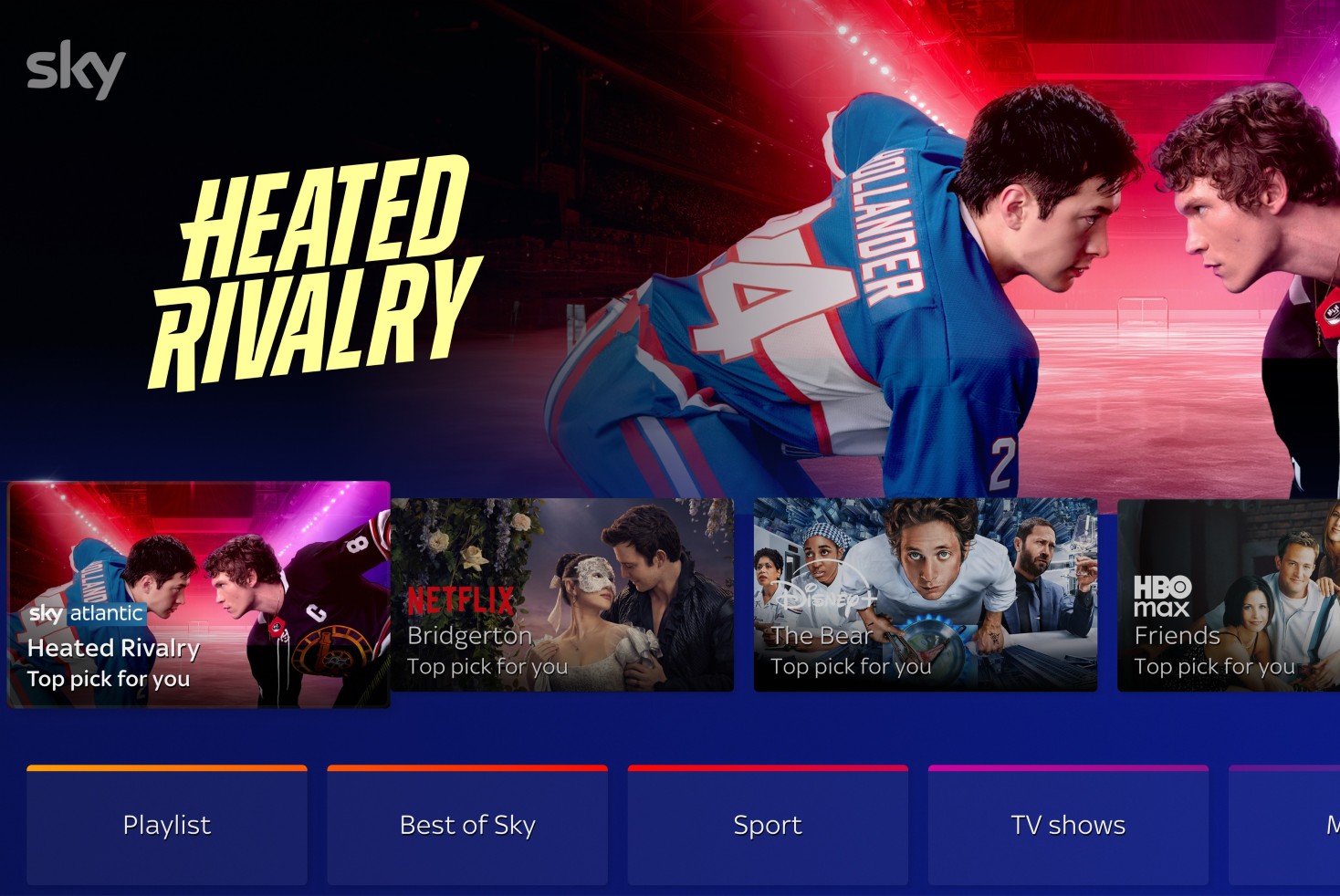

The streaming giant’s EMEA ads VP sat down with The Media Leader to discuss three years of ads on Netflix, and what is coming next.

The partnership features as part of a trend of supercharging a video-first approach in podcasting.

Panel at a Trade Desk event urged advertisers to think more carefully about the environments they appear in.

Analysis: Netflix joined Disney and Roku in partnering Amazon DSP as the streaming wars get collaborative on advertising.