Rajar Q4 2024

Commercial radio listening fell modestly from Q3 to Q4 to 39.9m, according to the latest Rajar figures, but year-on-year listeners still grew by 2%.

That’s one takeaway from the latest Rajar figures, which showed continued overall strength for commercial radio, despite a drawback in listening from a packed summer period. Throughout 2024, commercial radio audiences notably grew year on year in each quarter.

Meanwhile, total UK radio audiences also grew 1.4% year on year to reach 50.2m.

Matt Payton, CEO of audio industry trade body Radiocentre, called the Q4 Rajar figures “strong for commercial radio”, adding that its continued popularity “provides advertisers with incredible opportunities to reach huge audiences in a trusted environment”.

He continued: “The fact that online platforms and connected devices like smart speakers represent such a significant share of listening also reminds us of the importance of establishing a new regulatory framework for the industry. We look forward to working with Ofcom on the detail of this as it begins the process of implementing the Media Act.”

Global and Bauer performance

Among the two major commercial broadcasters, Global saw its sixth consecutive quarter of audience growth across its stations and now counts 27.8 weekly listeners in total. The broadcaster currently enjoys a 26.9% share of listening — something that founder and executive president Ashley Tabor-King said is “not something we would ever take for granted”.

“Smart speakers have made it easy to access our content and investment in entertainment apps like our own Global Player means people can reach a whole new world of digital content from our brands,” he explained.

On Wednesday, Global instituted programming changes to its Heart, Capital and Smooth brands as part of a broader Nations Strategy that aims to provide “national brands delivered locally” with touchpoints including news, travel and weather.

Meanwhile, Bauer saw 0.5% year-on-year growth in total weekly reach across its groups and individual stations (excluding partner stations). Including partner stations, Bauer’s weekly listeners now count 23.4m (+0.7% year on year).

Absolute Radio had a strong Q4, with all but two Absolute stations increasing their weekly reach.

Bauer Media Audio UK CEO Simon Myciunka said the results “demonstrate the strength of our brands” and singled out positive growth for Hits Radio and Greatest Hits Radio networks.

Here are four key takeaways from the Q4 Rajars.

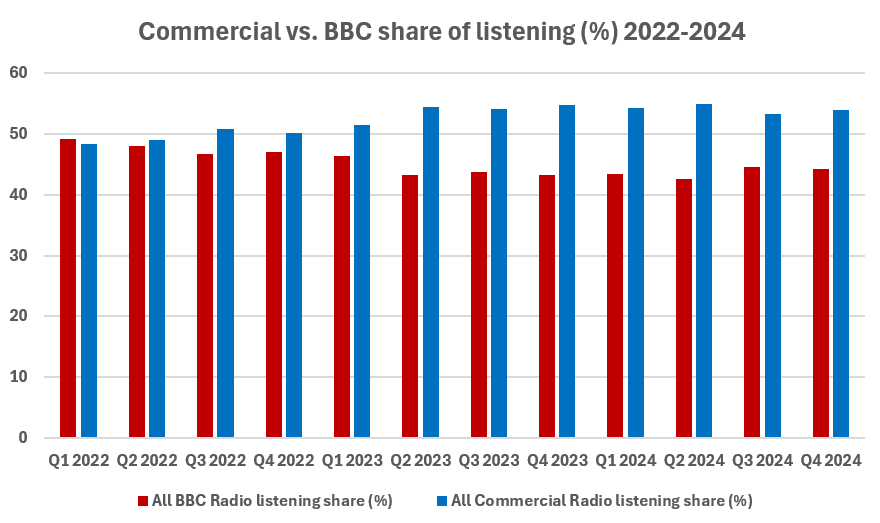

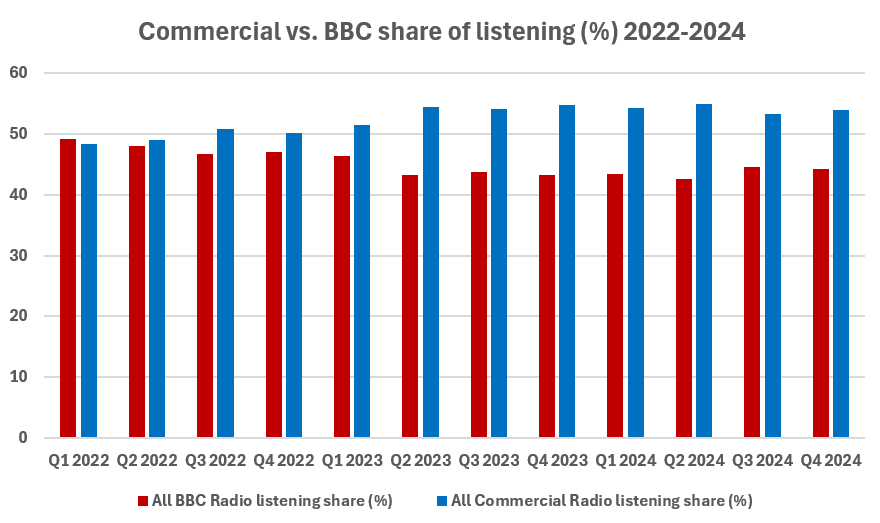

Commercial takes back share against the BBC…

Total radio listeners grew 1.6% year on year, driven by 2% growth in commercial radio listening.

After a contraction in listening share in Q3, commercial radio re-established its edge against the BBC in Q4. It currently counts 8.2m more listeners than the BBC and 39.9m listeners overall.

>> Read more: Commercial radio takes back listening share from the BBC

…but the BBC remains strong during breakfast

Still, the BBC reigns supreme during the breakfast slot.

Radio 2’s The Zoe Ball Breakfast Show grew quarter-on-quarter weekly reach by 8.7% in Q4 to expand its foothold as the UK’s top breakfast programme. Compared with the same period in 2023, the show has grown weekly reach by 4% to 6.8m weekly listeners.

Meanwhile, Radio 4’s Today remains the second-biggest show, despite a modest 1.9% quarter-on-quarter decline in weekly reach in Q4. The programme saw a jump in listenership amid a change in government leadership in Q3.

Among the commercial broadcasters, Global’s Heart Breakfast with Jamie and Amanda saw 6.3% year-on-year growth in weekly reach to 4m. Its audience remained practically flat quarter on quarter despite Jamie Theakston’s absence from the programme to receive treatment for cancer.

While Global’s Capital Breakfast with Jordan North, Chris Stark & Siân Welby has had perhaps the best year of any breakfast show with year-on-year growth in weekly reach of 19.9%, the “Jordan North effect” may have run out of steam in Q4, as quarter-on-quarter reach fell 1.9% for the programme in Q4.

>> Read more: Heart Breakfast grows despite Jamie Theakston absence

Talk radio shows mixed results

A number of talk radio stations notably saw declines in listening during the quarter, with only Global’s LBC (+9% to 3.4m) and Times Radio (+22.8% to 604,000) increasing weekly reach.

In the case of LBC, national audiences notably fared better than in London. Every LBC weekday daytime programme saw increases in reach, hours and share of listening year on year, with Nick Ferrari at Breakfast now reaching its highest-ever audience (1.5m).

Both Bloomberg and GB News saw substantial drop-offs in reach from Q3 (-23.9% and -23.4% respectively), potentially driven by a reduction in political interest following the conclusion of UK general election in Q3.

News Broadcasting’s Talk (formerly TalkRadio) also saw a 12.5% drop in reach compared with Q3, but a more substantial 30.5% drop since this time last year — the largest such reduction among talk radio competitors.

Digital listening share dips but online reach grows

Total share of digital listening dipped in Q4 and ended roughly flat year on year.

Digital listening accounted for 72.2% of the market, compared with 27.8% share for AM/FM listening. This is down from the previous quarter, when digital accounted for 74.3% of listening, and nearly flat compared with the same period in 2023 (72% digital and 28% AM/FM).

However, total online reach ticked up two percentage points to 44% in Q4. Indeed, online listening now accounts for nearly one-third (31.1%) of all commercial radio listening, up nearly three percentage points from Q4 2023 (28.9%).

Meanwhile, although more people are listening to radio online, those listening to AM/FM radio tend to listen for longer.

>> Read more: Share of digital listening dips

Adwanted UK are the audio experts at the centre of audio trading, distribution, and analytics. We operate J‑ET - the UK’s trading and accountability system for both linear and digital radio. We also created Audiotrack, the country’s premier commercial audio distribution platform, and AudioLab, the single-point, multi‑platform digital audio reporting solution delivering real‑time insight.

To scale up your audio strategy,

contact us today.