WPP Media downgrades ad growth forecast amid macro chaos

WPP Media has downgraded its global ad market forecast from anticipated 7.7% growth to 6% for 2025, citing “disruptions to global trade and continued deglobalisation pressures weighing on ad investment”.

The downgrade is the latest reflection of how the Donald Trump administration’s chaotic fiscal policy and combative foreign relations have dampened global business confidence, even as the ad market has remained relatively resilient.

“It’s impossible to know exactly where the economy is heading and we recognise the many economic uncertainties we face,” the report reads, in reference to the US market. “Our forecast assumes the administration will continue to de-escalate trade tensions and/or that businesses will effectively mitigate their impact on advertising investments.

“We also anticipate that the technology sector, including AI-related products and services, will provide a boost to advertising in the immediate and near term.”

According to Kate Scott-Dawkins, WPP Media’s global president of business intelligence and author of the This Year Next Year report, the expectation is nevertheless that “less robust growth” will come from the US and China — the two largest ad markets in the world — amid the “back and forth” over trade.

Tariffs have already had “impacts on all types of advertiser categories”, said Scott-Dawkins, and while WPP Media is not yet predicting a recession, it expects the US trade posture to begin having adverse effects on consumer spending in H2.

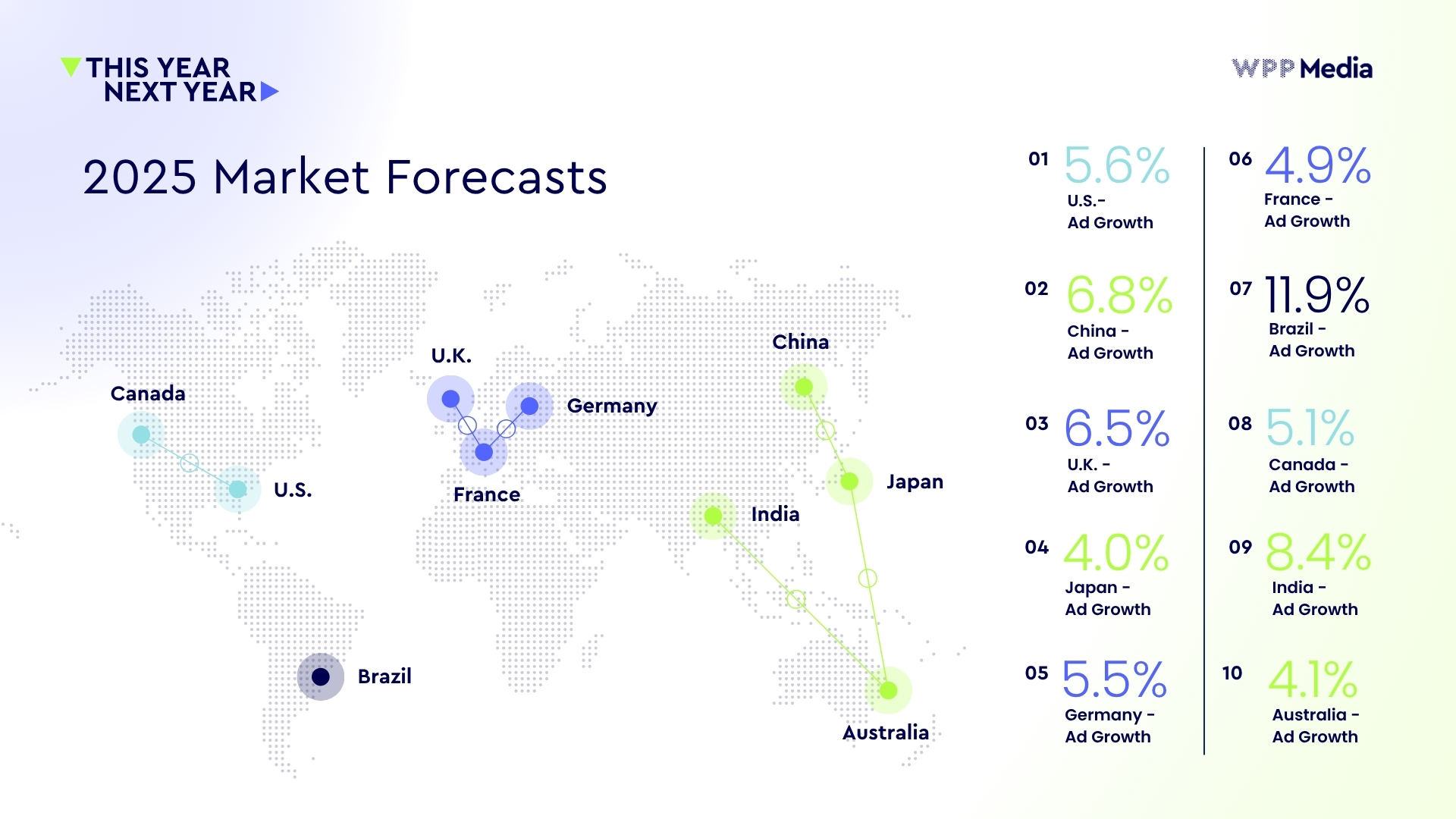

As such, the US ad market is now expected to grow by 5.6% in 2025 to $404.7bn — a downgrade from the 7% growth previously anticipated. China’s ad market is now expected to grow 6.8% to $211.6bn.

A new round of trade talks between the two countries is taking place in London this week in hopes of resolving tensions.

Scott-Dawkins indicated that some advertising activity that was previously going to occur in the US is now “shifting to the UK” and other English-speaking countries amid uncertainty in the US market. This is made possible by the ease at which campaigns can be adapted by global brands on digital channels.

“Money that was being spent on advertising by Temu and Shein in the US has shifted to other markets”, she pointed out.

Still, WPP Media downgraded the UK’s forecast from 7% growth to 6.5%, reaching $55bn.

WPP’s recently rebranded media investment arm expects global ad revenue to reach $1.08tn this year and predicts 6.1% growth in 2026.

Between 2025 and 2030, WPP Media is now forecasting a 5.4% compound annual growth rate (CAGR) — down from its previously projected 6.4% CAGR for 2024-2029.

UGC forecast to surpass professional content for ad revenue

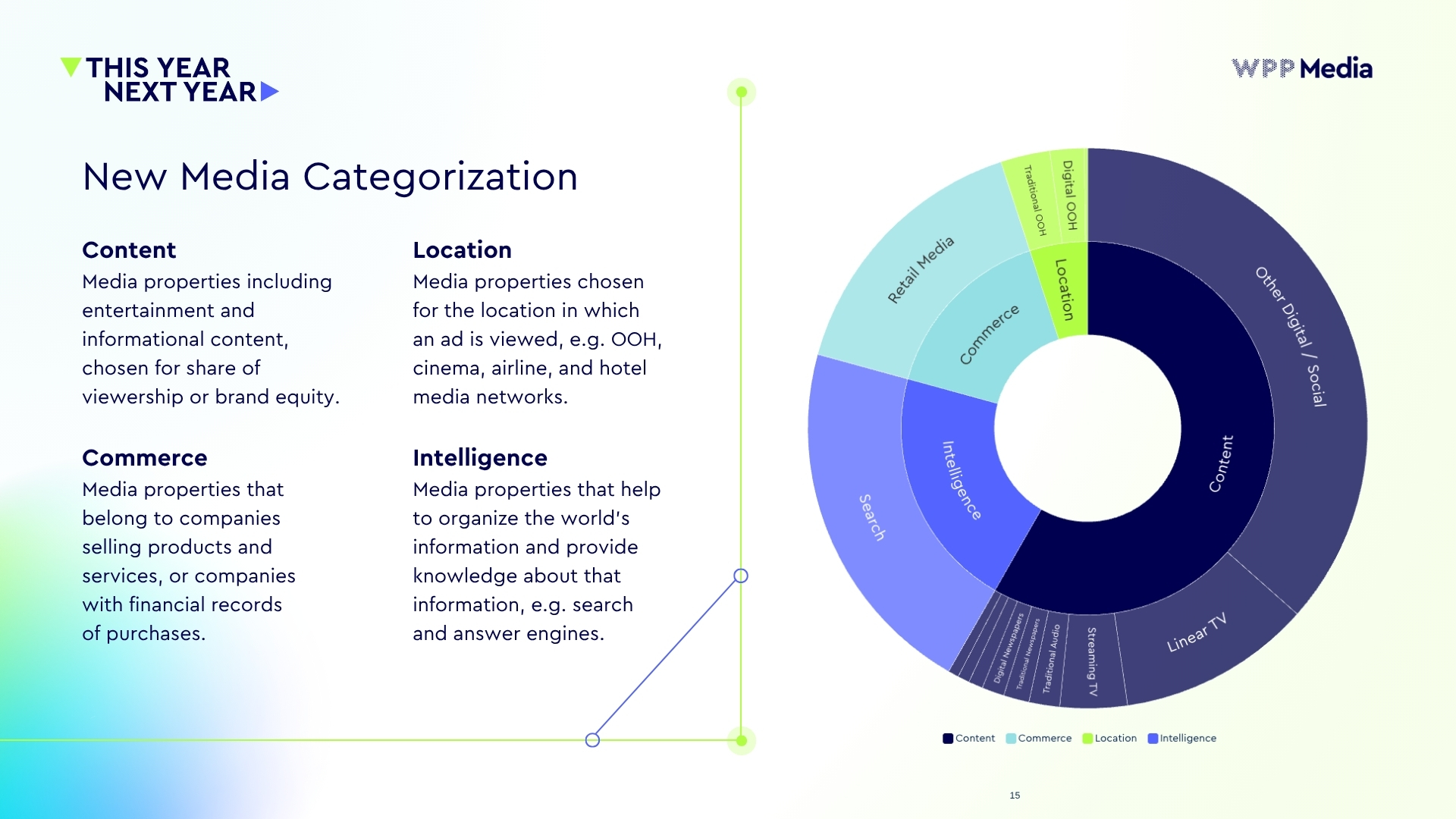

For the latest This Year Next Year mid-year update, WPP Media has developed a new taxonomy for media allocation “with an eye to what the motivation is from the client’s point of view”, according to Scott-Dawkins.

Media channels have been reclassified into the following categories: content-driven ad revenue (inclusive of digital and social, TV, audio and news outlets); commerce (effectively retail media); intelligence (essentially search, inclusive of Google’s new AI search modes); and location (OOH).

Content-driven ad revenue is expected to account for 58% of global media investment ($628.8bn) in 2025. Notably, however, commerce is expected to surpass TV revenue (inclusive of linear and streaming) for the first time this year to hit $169.6bn.

According to Scott-Dawkins, such growth in commerce is primarily driven by the US and China, with the latter forecast to account for 44.1% of retail media this year. Meanwhile, 8% of US retail giant Amazon’s total revenue is now comprised from advertising, according to WPP Media’s estimates.

Another first for 2025: user-generated content will account for a greater share of ad revenue than professional content, with platforms like TikTok, YouTube, Kuaishou and Instagram the largest beneficiaries.

Creator-generated revenue is currently expected to grow 20% this year to $184.9bn and more than double to $376.6bn by 2030.

In contrast, traditional media channels are anticipated to grow more modestly or even shrink.

TV (including streaming) is anticipated to grow 1% this year to $162.5bn. OOH ($52bn forecast) and audio ($26.5bn) are both predicted to remain relatively flat. Print advertising, inclusive of its digital counterparts, will continue to decline by 3.1% in 2025 to $45.4bn.

Stark difference in spend by advertiser size

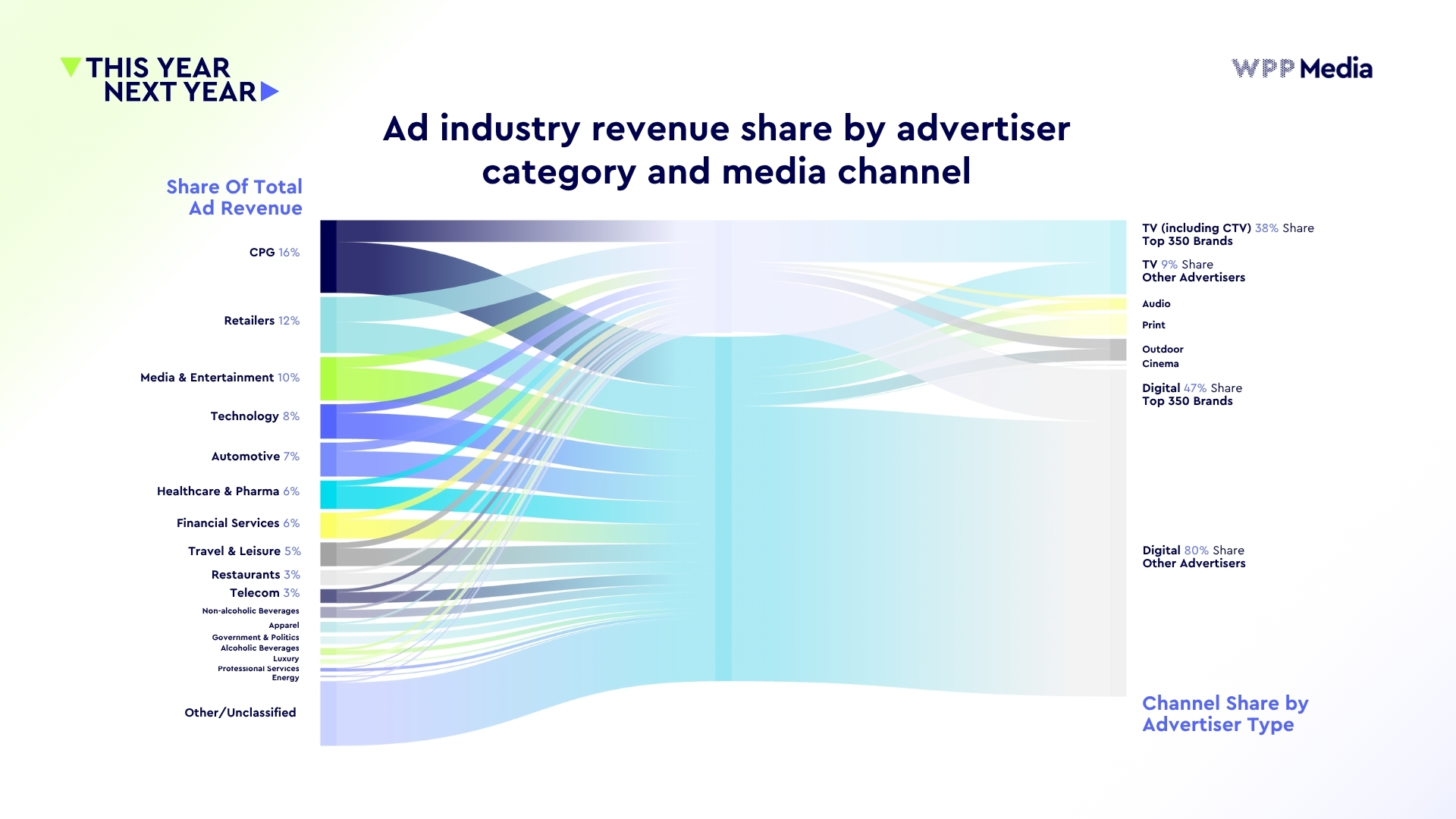

However, the report found that the vast majority of digital growth is “being driven by the long tail”. So, for the first time, WPP Media has released a split view of ad revenue, comparing how the top 350 largest global brands spend relative to small and medium-sized businesses (SMBs).

The effort to provide a split view had been recommended by UK TV industry trade body Thinkbox, whose head of research Anthony Jones argued in March that global and market-level growth figures were being skewed by SMBs over-indexing on search and social media — “not real advertising investment as we would historically view it”, he said.

Scott-Dawkins confirmed that “channel allocations do actually look quite different”, depending on the size of the advertiser.

Among the top 350 brands, for example, TV accounts for a 38% share of media spend, while 47% of spend goes to a variety of digital channels.

In comparison, 80% of adspend from the rest of the market is spent on digital, with such advertisers only spending 9% on TV.

Regardless, digital formats clearly have momentum as two-thirds of media leaders surveyed by WPP Media agreed that “most consumer interaction with brands will happen bot to bot in 2030”, with users predicted to increasingly use large language models for product recommendations and automated purchasing.

WPP has itself remade its image for the AI-driven future, recently launching an AI-driven “large marketing model”, dubbed Open Intelligence, aimed at driving efficiencies for clients.

Demonstrating the tool at the inaugural SXSW London last week, outgoing WPP CEO Mark Read admitted there is “no doubt” that, for media companies to “do the work we do today, there will be fewer people involved” thanks to AI.

WPP has reportedly conducted large-scale lay-offs amid changes to its agency structure.

Despite the risk of widespread redundancies across white-collar industries due to AI, the same two-thirds of experts surveyed by WPP Media said it was “unlikely” that the application of AI will result in diminished consumer purchasing power by 2030 due to job loss. Rather, they expect more job creation instead.

But there are a large number of unknowns the media industry will be forced to grapple with over the next five years, with Scott-Dawkins using the report as a “call to arms” for leaders to “think deeply and act on how we want AI to exist in the world of media, advertising and content”.

She warned: “As interactions shift from people visiting sites and clicking on links to information being summarised by those sites and fed to a person, what does that mean for the business model of the web? For the business model of content and news?

“How do we foresee the continued training of AI, which up to this point has been done primarily on human-generated content? Does that transition into a place where AI is generating content for the web that is read by other AI?

“There are no answers to this, I’m afraid. But it’s certainly something all marketers should be thinking about and aware of.”

‘Death of the website’: Publishers wrestle with the need to reinvent in AI era