Rajar Q3 2024

Amid what has thus far been a strong year for commercial radio, Q3 presented a blip in terms of total listening, with weekly reach dipping 0.9% from last quarter to 40.1m listeners. Year on year, however, commercial radio listening still grew by 2.1%.

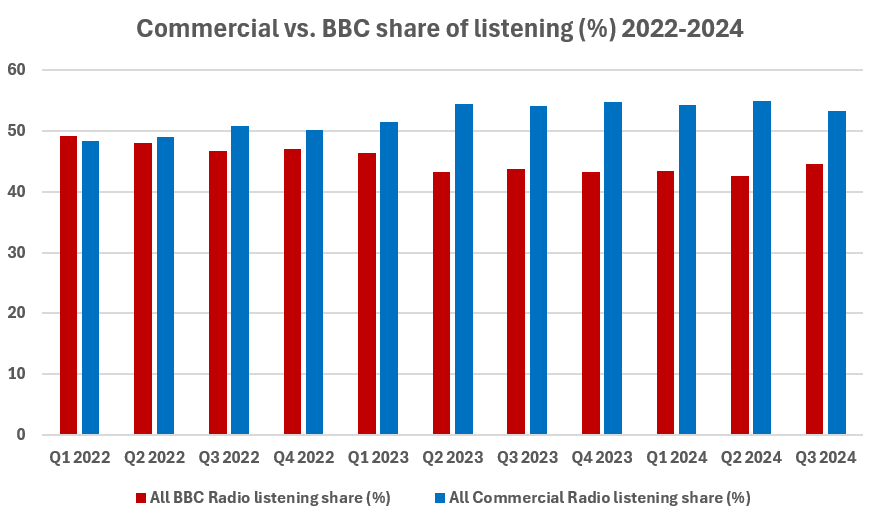

The BBC has shown a positive three months, gaining back a relatively modest share of listening from commercial radio — bucking a year-long trend.

Still, year-on-year growth at major commercial stations remained positive in Q3, as both Global and Bauer grew total weekly reach among their portfolios of stations.

Global posted its fifth consecutive quarter of audience reach growth, with Heart (+14.6%), Capital (+21.2%) and Smooth (+23.5%) performing strongly.

Global founder and executive president Ashley Tabor-King noted the achievement, saying: “Radio is thriving and Global is outperforming the market, as we keep a laser focus on our content, whilst also embracing technology at the core of our strategy, as people use smart speakers and apps, as well as traditional means, to get to the content they love, wherever and whenever they want it.”

Bauer also grew its Hits Radio network by double digits year on year (10.7% to reach 7.2m weekly listeners), with its main station more than doubling year on year to 4.6m.

Gary Stein, Bauer Media Audio UK’s director of audio, commented: “We’ve invested significantly in Hits Radio and it’s fantastic to see such brilliant results for the network as it grows to a new record reach, while Greatest Hits Radio continues to be the UK’s most-listened-to commercial station.”

He added that Absolute Radio also enjoyed a “standout performance” in Q3 with record audiences.

Here are four key takeaways from the Q3 Rajars.

BBC shows resilience

The BBC clawed back share of listening relative to commercial radio for the first time in a year, thanks to a boost in listening — particularly BBC Radio 4’s Today programme as well as Radio 5 Live, Radio 1 and Radio 3.

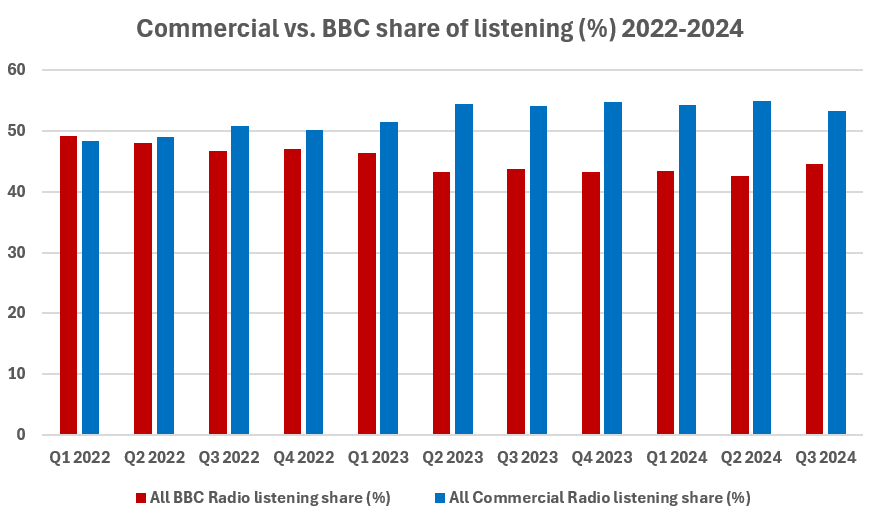

Still, the broader years-long trend has thus far been in favour of commercial radio’s growth. Commercial radio overtook the BBC in terms of share of listening for the first time in two decades in Q2 2022 and since then has continued strong growth momentum relative to the Corporation.

Since Q2 2022, commercial radio has not lost share of listening to the BBC for two consecutive quarters.

>> Commercial radio loses share to BBC

LBC jumps in popularity

Global’s LBC became the top London station during the breakfast slot this quarter, unseating Heart London, which had itself unseated Capital London in the previous quarter.

More generally, LBC grew weekly reach by 9% year on year — part of a broader growth story Global has experienced over the past year. Total listening across Global stations has jumped 11% year on year.

At The Future of Media London this month, LBC presenter James O’Brien described the importance trust plays in his own work hosting LBC’s mid-morning show.

‘Jordan North effect’ continues

Global’s Capital Breakfast continued to see growth in listenership following the addition of Jordan North to its presenting line-up alongside Chris Stark and Siân Welby last quarter.

Whereas the show saw a 10.2% quarter-on-quarter spike in listening in Q2 immediately following North’s joining, in Q3 the show grew by a more modest 5.4% quarter on quarter.

In year-on-year terms, Capital Breakfast now reaches 19.1% more listeners weekly (3m).

Of note among breakfast shows, BBC Radio 4’s Today programme saw a bump in listenership in the period.

>> Today programme gets breakfast boost

Digital dwarfs traditional listening

Total digital listening share continued to tick up in Q3, now making up 74.3% of radio listening compared with just 25.7% for AM/FM.

It is a considerable difference from last year, when AM/FM still held a 29.7% share, implying a continued trend away from traditional radio listening towards digital.

Growth in digital in Q3 was largely driven by more DAB listening.

Share of smart speaker listening has also grown 22% year on year from 13.8% in Q3 2023 to 16.9%, although it is flat from the prior quarter.

>> Share of digital listening increases amid continued DAB growth

Adwanted UK are the audio experts at the centre of audio trading, distribution, and analytics. We operate J‑ET - the UK’s trading and accountability system for both linear and digital radio. We also created Audiotrack, the country’s premier commercial audio distribution platform, and AudioLab, the single-point, multi‑platform digital audio reporting solution delivering real‑time insight.

To scale up your audio strategy,

contact us today.